Apple Faces Criticism Over Its Cooperation With China

Lawfare’s biweekly roundup of U.S.-China technology policy and national security news.

Published by The Lawfare Institute

in Cooperation With

Apple has faced heat in recent weeks over its compliance with Chinese laws in order to continue its operations in China. Obeying local law in China means that Apple shares consumer data with the government and censors content according to Chinese government standards. The company has removed certain apps from the Chinese Apple app store, including programs used by Hong Kong protesters to track the police and VPNs used by Chinese internet users to evade censorship.

Apple relies on China to manufacture many of the components used in its devices but also sells its devices to Chinese users in large numbers. Some U.S. tech giants, like Facebook, are blocked in China, while others, like Amazon, are not competitive with their Chinese equivalents. Google had previously flip-flopped on its decision to operate in the country; many of its services are now effectively banned.

The critiques of Apple’s business in China come in the midst of a spat between Apple and companies like Facebook and Google, whose business models depend on targeted advertising. In its latest version of iOS, Apple rolled out several new privacy-protecting features, most significantly an opt-in to tracking by third-party apps. This new feature seems poised to take a chunk out of Facebook’s revenues as consumers ask apps “not to track” them in droves. While implementing these changes, Apple has criticized Facebook’s ad-based business model both implicitly and explicitly.

In return, Facebook has publicly called out Apple’s hypocrisy on privacy given its massive operations in China, and the U.S. media caught on. The Washington Post’s editorial board is urging Apple to diversify its supply chain so that it can better resist (or avoid altogether) China’s demands for consumer data. Robert Hackett, a senior writer at Fortune magazine, writes that Apple’s iCloud policies in China need to change.

Such double-binds may become increasingly common for multinational corporations attempting to please both the United States and China, Trivium China suggests. For example, while the U.S. Cloud Act enables the subpoena of data held anywhere in the world, Chinese law forbids such requests. Compliance with local laws raises ethical and business questions for U.S. tech companies operating in countries beyond China. India is also weighing a new data privacy law that would require data to be stored on Indian soil; one commentator posits that the law would present similar problems for U.S. multinationals like Apple, Facebook and Google.

Senate Opens Debate on Bill to Counter China in Advanced Technology

On May 17, the U.S. Senate voted to open debate on the Endless Frontier Act, which would provide $100 billion in funding for scientific research and development in strategically critical fields including artificial intelligence. The bill as currently written expands the National Science Foundation (NSF) and refocuses the institution on advanced technology, while also creating “regional tech hubs” through the Department of Commerce. One group of senators is intent on adding funding for development of cutting-edge semiconductors.

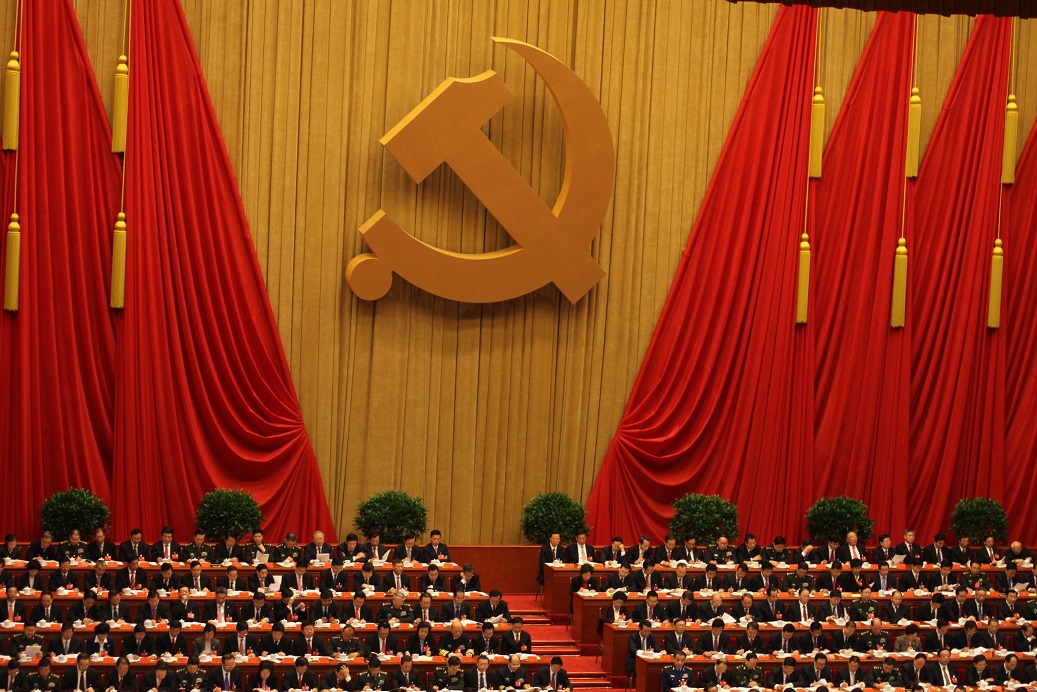

The bill is designed explicitly to counter China’s progress and investment in advanced technologies. Senate Majority Leader Chuck Schumer stated on the Senate floor: “We can either have a world where the Chinese Communist Party determines the rules of the road for 5G, artificial intelligence and quantum computing—or we can make sure the United States gets there first.”

Congress has shown an unusual willingness to make bipartisan deals on issues related to China; hawkish stances on China have become so commonplace that Sen. Marco Rubio said last month: “[I]f we can’t agree on a bill regarding China, we should probably close this place.”

But, over the past week, lawmakers have whittled the amount of new funding intended for the NSF, originally $100 billion over five years, down to a mere $2 billion additional funding per year. The additional spending has been either reshuffled to other agencies, like the Department of Energy’s National Labs, or scrapped altogether. Some commentators have gone so far as to call the Endless Frontier Act “neutered” by the large spending cuts over the past few days. Meanwhile, special-interest provisions are making their way into the legislation, perhaps because lawmakers hope that their colleagues’ desire to look tough on China will outweigh their reservations about the individual set-asides.

On April 22, Chinese Foreign Ministry spokesperson Wang Wenbin said with respect to the Endless Frontier Act: “We would be happy to see greater development and progress made by the U.S., but we are firmly opposed to making an issue out of China at every turn and targeting China.”

A recent poll conducted by Data for Progress and Vox suggests that, in the United States, anti-China messaging may not be necessary to garner popular support for government investment in technology.

U.S.-China Competition Heats Up in Africa and Latin America

A U.S.-backed consortium led by Vodafone won a recent telecommunications auction in Ethiopia. Its competitor was a South African company with Chinese investment backing. The Vodafone consortium will now build out Ethiopia’s first nationwide 5G network—with the caveat that no Huawei or ZTE equipment will be purchased with American funds. The U.S. agency funding the Vodafone project, the International Development Finance Corporation, was created in 2019 in an attempt to provide U.S. alternatives to Chinese infrastructure financing.

The opportunity to define next-generation telecom infrastructure for a strategic American ally is seen as a win for Washington in a mounting U.S.-China “proxy war” over mobile networks and devices on the African continent. The Washington Post reported in April that Huawei plans to launch its own operating system, Harmony OS, to compete with Google’s Android, which is currently the most popular operating system for African users. Harmony would give Huawei the power to banish apps, control advertising content and simplify compatibility with Chinese-made apps. The Post suggests Huawei might even decide to ban the use of Google Android on its devices altogether.

Meanwhile, China is pressuring Latin American countries to downgrade or sever relations with Taiwan by withholding badly needed vaccines, as the region experiences a surge in coronavirus cases. President Biden’s administration has promised to distribute U.S.-made vaccines to other countries, but as of now, many Latin American countries are relying almost exclusively on Chinese vaccines.

China surpassed the United States this decade as the biggest trading partner to Brazil, Chile, Peru and Uruguay. NBC reports that, since 2017, Panama, the Dominican Republic, and El Salvador have de-recognized Taiwan; Paraguay, which refused to do so, no longer receives Chinese financing for infrastructure or preferable treatment in exporting to China.

Other News

China Discourages Crypto Use in Banks and Payment Platforms

Some outlets have interpreted the recent fall in Bitcoin prices as the result of Elon Musk’s tweets. Perhaps Chinese regulators also have something to do with it.

On May 18, three Chinese self-regulatory organizations (SROs) in the banking industry announced new prohibitions on member institutions regarding cryptocurrencies. The China Banking Association, the National Internet Finance Association of China, and the Payment & Clearing Association of China jointly announced that their members, Chinese banks and payment and lending platforms, would be prohibited from providing services related to cryptocurrencies. The guidance on providing services is more expansive than the previous prohibition passed in 2017. After 2017, some crypto trading platforms still were able to process transactions into personal bank accounts. Now, banks are banned from performing exchanges of cryptocurrencies for yuan or foreign currencies. They are also barred from accepting or using cryptocurrencies as a form of payment.

Although the SROs are not officially connected with the Chinese government, their announcement reiterated Chinese regulators’ position that cryptocurrencies “are not real currencies.” Some commentators link this new move with China’s October 2020 ban of all competitors to its own digital yuan. Since the announcement, cryptocurrency miners have begun to exit China, which has been a popular spot to set up a mining enterprise thanks to its cheap energy. (Miners were already being “squeezed” by Chinese regulators’ new restrictions on energy consumption, which have intensified recently as part of China’s effort to go carbon neutral.)

The SRO policies signal an about-face from the apparent openness evinced by the statements of Li Bo, the deputy governor of the People’s Bank of China, last month. He called crypto assets an “investment alternative,” sparking hopes for a more “progressive” stance on crypto regulation in China.

The new policies are more in line with statements by Vice Premier Liu He, who promised on May 21 that China plans to “crack down” on bitcoin mining and trading. The day of Liu’s statements, the value of Bitcoin dropped 12 percent.

China’s Pressure on Big Tech Causes Leadership Turnover

China’s increasing regulatory pressure on its tech unicorns and growing geopolitical tension with the United States is prompting some Chinese tech leaders to step down. Colin Huang, founder of Pinduoduo, departed the company in March. Ant Group’s chief executive, Simon Hu, left Ant in March. Now, ByteDance co-founder Zhang Yiming has decided to step down. Meanwhile, Jack Ma, founder of Alibaba and Ant, has made few public appearances since China’s regulatory crackdown on his companies began in November 2020.

The changes are not limited to leaders in China; the CEO of TikTok’s U.S.-based operations, Kevin Mayer quit in August 2020, citing changes in the political environment. Mayer was finally replaced by Shou Zi Chew, a former ByteDance executive based in Singapore, in May. Although the Biden administration has temporarily paused the former Trump administration actions against TikTok, ByteDance and WeChat (owned by Tencent), U.S.-China tensions over tech seem poised to continue. China, meanwhile, continues to put pressure on its own domestic technology companies, which may mean more leadership personnel turnover in the near future.

Commentary

As Americans fret over a potential exodus of Chinese STEM talent, Tomas Sidenfaden reports in Foreign Policy that China’s overseas tech talent is “torn over going home.”

Nina Luo writes for New Republic on the effects of anti-China sentiment and policy in Congress and the White House on Asian American and Pacific Islander communities.

Charles Glaser in Foreign Policy defends his argument that more serious thought is needed about whether or not to maintain the U.S. security commitment to Taiwan.

A number of commentators weigh in with ChinaFile on how the United States should respond to China’s civil-military fusion.

As Presidents Putin and Xi unveil a new joint nuclear energy project, and Putin says Sino-Russian relations are at their “best level in history,” Andrea Kendall-Taylor and David Shullman write for Foreign Affairs on the “convergence” of China’s and Russia’s interests and the potential ramifications for U.S. foreign policy.

China’s population is aging; according to Wei Sheng of TechNode, this trend may soon make it difficult for Chinese tech startups and technology factories to find labor.

David Dollar and Don Clark, writing for the Brookings Institution, attempt to assess the causes and potential duration of the global semiconductor shortage.

For the Council on Foreign Relations, Eli Clemens explores the troubling increase in cyber and information operations by China-based groups like Evil Eye.

Jonathan Putnam, Hieu Luu and Ngoc Ngo published a new report for the Hudson Institute on how China’s subsidized patent application system affects its leadership of the global innovation race.