Commission Criticizes Lack of Preparedness; U.S. Likely to Implement Sweeping Rule on Tech-Related Transactions

Published by The Lawfare Institute

in Cooperation With

The National Security Commission on Artificial Intelligence (NSCAI) published its final report on March 1. The report stresses the importance of domestic investment in innovation and education, as well as a transformation of the federal approach to technology in national security. At the moment, the report indicates, the United States is “not prepared” to compete with China in a global technological competition.

The NSCAI recommends only tailored restrictions (for instance, on advanced semiconductor technology) on exports to other countries. Meanwhile, the Department of Commerce appears set to move forward with a rule introduced by the Trump administration that could constrain a broad array of tech-related business transactions involving a “foreign adversary.”

As currently written, the rule would authorize the Commerce Department to require licenses for, or disallow entirely, a host of transactions involving technologies deemed to be national security threats. (Any transactions already under the purview of the Committee on Foreign Investment in the United States will be exempt.)

The purpose of the rule is reportedly “to prevent foreign adversaries from exploiting vulnerabilities” in technology supply chains, especially in information and communication services. The rule specifies that China, Russia, Iran, North Korea, Cuba and the Maduro regime of Venezuela are “foreign adversaries,” though this may not be an exhaustive list.

In addition to the NSCAI’s suggestions for more selective export controls, at least two experts have proposed revisions to the rule that avoid “blanket bans” in favor of narrower prohibitions and more uniform security standards.

The rule is scheduled to go into effect on March 22. If it moves forward, it will indicate the Biden administration’s willingness to maintain sweeping controls on technology-related commerce.

Tech and the Two Sessions

At the “Two Sessions”—the annual meetings of China’s most important political bodies, the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC)—tech leaders have offered support and proposed new ideas for government policy initiatives including rural revitalization, carbon emissions reduction and accelerated development of artificial intelligence. Alibaba, JD and Pinduoduo are pitching in to boost the “smart agriculture” sector, after the National Rural Revitalization Bureau officially opened on Feb. 25. Chinese tech firms appear to be availing themselves of a remaining area of cooperation between themselves and the central government.

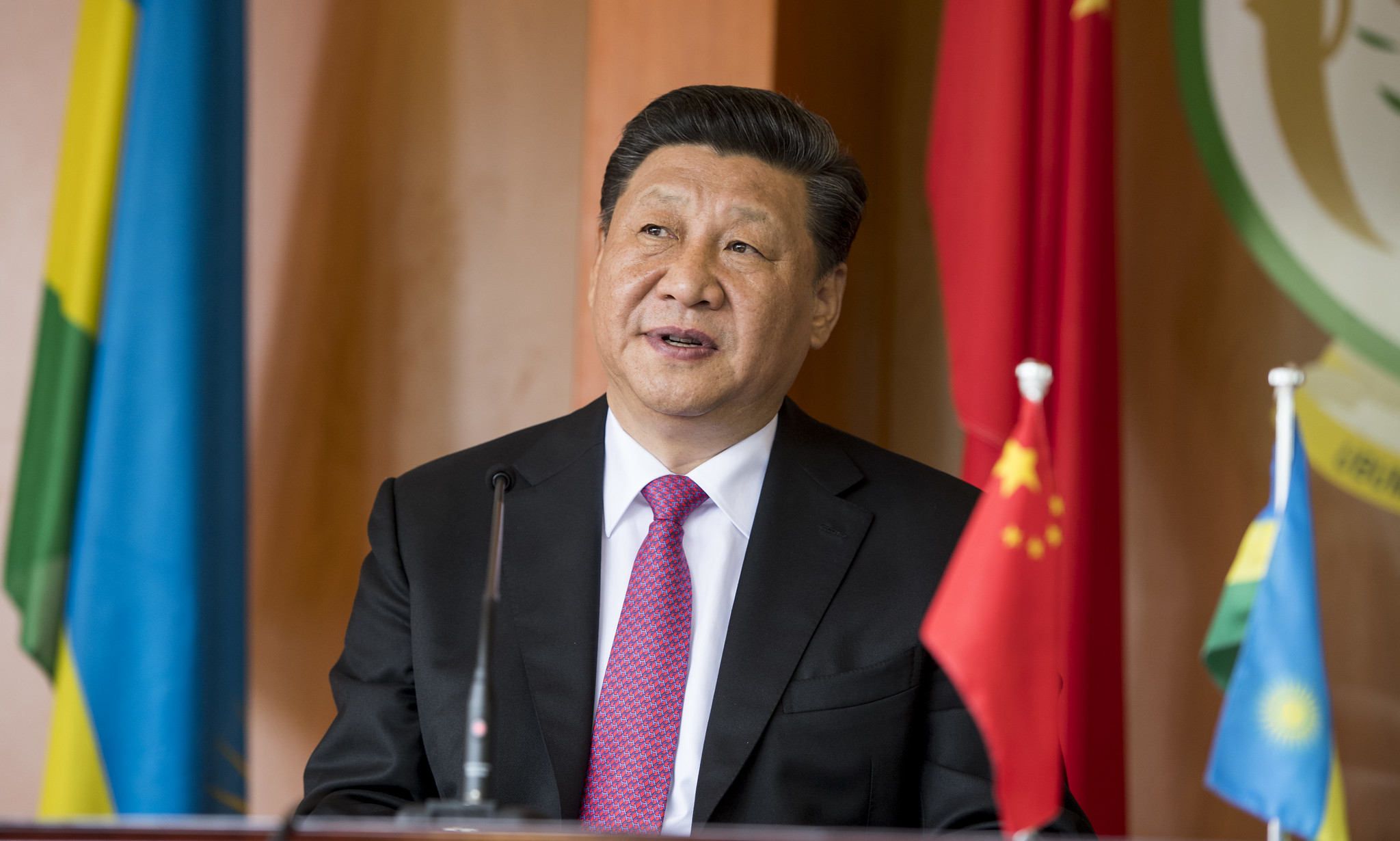

The 14th Five-Year Plan, released March 5, suggests that the central government is focused on winning the tech war. The Chinese strategy relies in part on “indigenous innovation”—a combination of basic scientific research investment and competition-friendly regulation. (It’s worth remembering that the Chinese effort toward technological innovation has been part of President Xi Jinping’s tenure for more than a decade and may stretch back as far as former Chinese President Jiang Zemin.)

The CPPCC is set to hear a proposed law for greater regulation of facial recognition technology and personal data. And protections of data privacy, along with labor rights, are expected to be bolstered by the NPC, possibly as a way to ease approval in Europe of the recently signed Chinese-European trade and investment agreement and to prepare for a potential entry into the Comprehensive and Progressive Agreement for Trans-Pacific Partnership.

Ant Walks a Tightrope

The head of the China Banking and Insurance Regulatory Commission (CBIRC), Guo Shuqing, said on March 1 that he expects all financial technology firms in China to comply with new financial reporting and capital requirements within two years. In February, the CBIRC introduced fresh rules for co-lending with banks, which will force online lenders to hold significantly more capital than was previously required.

In response, Ant Group, one of the largest fintech firms to have been affected by China’s recent regulatory crackdown on the sector, is reportedly moving its micro-lending businesses into a new consumer finance unit. Consumer finance businesses in China currently enjoy a more lenient capital-to-lending ratio than online lending businesses. Still, Ant’s credit businesses will face higher capital requirements, per draft rules promulgated in November 2020. And the firm has not finished raising capital to meet those minimums. It appears that the deal struck with Chinese regulators to move all of Ant’s units into a financial holding company remains in place.

But Ant Group founder Jack Ma has reportedly decided not to comply fully with Beijing’s requests for data disclosure. Ant has one of the biggest pools of consumer credit data in China. Some of the company’s data on individuals who have taken out loans from Ant lending products Huabei and Jiebei has been shared with Chinese authorities, and Ant has agreed to share more. Yet regulators are so far unhappy with its level of compliance.

Ma is simultaneously attempting to soothe employees who receive share-based compensation. Those workers expected a payday in the initial public offering (IPO) back in November, which was canceled (possibly, according to some reports, because the offering’s would-be beneficiaries were President Xi’s political challengers). Valuation of the company has dropped since and may drop further. Though Ma insists that the IPO will happen eventually, the timing is uncertain.

China Takes Steps Toward Emissions Reduction

Chinese regulators and major state-owned firms have taken major steps in recent weeks toward lowering China’s long-term carbon emissions. In September 2020, President Xi pledged that China would speed its voluntary emissions targets, reaching peak carbon emissions by 2030 and full carbon neutrality by 2060. In December 2020, Xi upped that commitment even further, promising “at least” 65 percent reduction of emissions from 2005 levels by 2030.

China is currently the world’s largest carbon emitter, responsible for 30 percent of global emissions. Due to China’s heavy reliance on coal to produce electricity, per-capita emissions rates in China exceed those of most western European countries. Recent efforts by regulators and state-owned utility firms demonstrate initial progress toward Xi’s aggressive decarbonization goals.

The State Grid Corporation of China, a state-owned company and the world’s largest public utility, announced its carbon neutrality action plans on March 1. It is the first state-owned enterprise to release such a plan, aiming to “build a diversified clean energy supply system” over the next five to 10 years. On the supply side, the plan increases development of wind, solar and hydro power. On the consumption side, the plan aims to promote the use of electric energy over coal- and other fossil-fuel-based sources. Some large private firms, including Tencent and Huawei, have already unveiled their carbon neutrality plans.

Chinese regulators are stepping up this week to speed the launch of China’s first carbon trading program. Officially opened on Feb. 1, China’s carbon market scheme assigns emissions caps to Chinese power plants and allows under-emitters to trade their carbon credits on an open exchange. The first phase of the roll-out encourages the 2,225 participating power plants to accurately gather and report data on their past electricity usage, allowing national bureaucrats to set appropriate quotas for each power plant. The carbon market roll-out is not expected to be complete for three to five years. Still, experts call China’s carbon markets the largest and most ambitious implementation of a carbon trading scheme anywhere in the world.

Meanwhile, provincial officials have recently cracked down on cryptocurrency mining in the name of emissions reduction. On Feb. 25, regulators in Inner Mongolia released draft regulations banning new cryptocurrency mining projects and requiring those currently in operation to shut down by April. Cryptocurrency mining is highly energy intensive, with global mining activity responsible for 0.5 percent of global energy consumption in 2020. Nearly half of all bitcoin mining worldwide takes place in China, and eight percent takes place in Inner Mongolia.

Inner Mongolia, with some of the cheapest electricity in China, is a popular place for cryptocurrency miners to set up shop. But the cheap electricity derives from the region’s heavy reliance on coal, which comes with high carbon emissions. China’s top economic planner recently criticized Inner Mongolia as the only province that failed to control energy consumption in 2019. Facing national pressure, provincial leaders have pledged to reduce emissions by 1.9 percent in 2019. Some bitcoin miners in Inner Mongolia have already begun transferring their operations to Sichuan and Yunnan provinces, which have relatively abundant and cheap hydropower.

The draft regulations are set to go into effect on March 10.

Semiconductor Shortage Changes Balance of Power

Semiconductor Manufacturing International Corporation (SMIC), China’s largest semiconductor manufacturer, may enjoy a respite from U.S. sanctions due to a global chip shortage, which has hit American automakers especially hard.

U.S. suppliers’ inability to quickly supply SMIC with equipment and materials, thanks to the Department of Commerce’s increased scrutiny of sensitive exports, is delaying SMIC’s chips and thereby worsening the shortage. Congress is considering whether to loosen restrictions on these exports to enable higher levels of global chip production.

This approach, however, has sparked worries that SMIC could benefit from the shortage. Some lawmakers have proposed instead a $30 billion government investment in the U.S. chipmaking industry, to be brought to a full Senate vote in April.

Meanwhile, Taiwan, home of the industry-leading Taiwan Semiconductor Manufacturing Company, stands to benefit from the global shortage. The company accounts for more than 50 percent of the global chipmaking market, worth $440 billion in 2020. U.S. demand for semiconductors has increased Taiwan’s leverage in free trade negotiations with the United States, which have been on and off since 1994. Taiwanese chipmakers have voiced concerns about their ability to meet global demand if it remains high in 2021, leaving a possible market opening for SMIC.

China Joins Cross-Border Digital Currency Pilot

China has joined a cross-border digital currency initiative with the central banks of Thailand, the United Arab Emirates and Hong Kong. The People’s Bank of China signed on to the Multiple Central Bank Digital Currency (m-CBDC) Bridge project led by the central banks of Thailand and Hong Kong. The project will use digital ledger technology, similar to blockchain, to make cross-border payments more efficient. According to an announcement from Hong Kong’s central bank, the m-CBDC will “facilitate real-time cross-border foreign exchange payment-versus-payment transactions in a multi-jurisdictional context and on a 24/7 basis.”

China has aggressively expanded trials of its own digital currency in recent months, giving out more than $23 billion to tens of millions of citizens for use at popular retailers. In recent weeks, MYBank, a subsidiary of Ant Group, and WeBank, a subsidiary of Tencent, have signed on to the digital yuan trials. China is expected to promote its digital currency at 2022 Winter Olympics venues in Beijing.

Internet Controls Tighten in Hong Kong

Internet controls are coming down on Hong Kong as China tightens its grip on the territory.

In February, the police cracked down on HKChronicles, the blog of a young pro-democracy protester that publicized local police officers’ social media accounts and home addresses. Citing compliance with the new national security law, Hong Kong Broadband Network, an internet service provider, rendered the site inaccessible.

The same day, the Broadband Network noted that any new .hk site registration could be rejected, based on its new “acceptable use” policy. The Hong Kong Security Bureau stated that lawful use of the internet in Hong Kong would remain unfettered.

On Jan. 29, Hong Kong began to consider a requirement for real-name registration for SIM cards, which would link personal identities to data transmitted by mobile phone. On Feb. 4, Hong Kong Chief Executive Carrie Lam promised new laws to prevent “doxxing” and fake news; the Hong Kong Journalists Association has objected, citing risks of silencing reporters. On Feb. 7, an internet radio host who supported the protests was charged with “seditious intent” under the national security law. On Feb. 12, access to the Taiwan Transitional Justice Commission website was revoked.

Activists are deploying blockchain technologies to preserve data on the recent events in Hong Kong, but they expect their efficacy will be limited once the government catches on.

Commentary

Deborah Seligsohn, Jenny Lei Ravelo, Daniel Russel, Elanah Uretsky and Elina Noor comment for ChinaFile on China’s global vaccination drive.

Mercy Kuo of Pamir Consulting speaks to The Diplomat on the impacts of the Clean Network Initiative and best steps for the Biden administration’s technology strategy.

The China Media Project publishes a summary of Chinese political rhetoric in 2020.

Darren Byler translates and analyzes excerpts from the brief, unfiltered discussion on Clubhouse between Uighurs and Hans about repression in Xinjiang.

Eric Cheung for Rest of World explains why Facebook is losing ground in Hong Kong to MeWe, WeChat and Weibo among pro-democracy groups.

Ryan Hass argues in Foreign Affairs that “China Is Not Ten Feet Tall” and that alarmism on China undermines U.S. foreign policy.

Bonnie S. Glaser and other Center for Strategic and International Security (CSIS) experts compile an analysis of China’s 2021 defense budget. Also for CSIS, Stephanie Segal outlines a potential framework for U.S.-China economic cooperation.

A new study by Eric Robinson and Sean Mann at the Rand Corp. uses nighttime lighting data to assess the growth of China’s detention facilities for Uighurs in Xinjiang province.

John Lee, a senior fellow at the Hudson Institute, writes for The Australian on the need for big tech to help liberal democracies counter authoritarian China.