Published by The Lawfare Institute

in Cooperation With

Hacks and Attacks

Amid the uproar following the hack and subsequent leak of the DNC’s emails this week and the suspicion (and many say near certainty) that Russia is behind it, it is worth considering our cyber vulnerabilities—and targets of potential Russian interest. In a Columbia Energy Exchange podcast earlier this week, Federal Energy Regulatory Commissioner Cheryl LaFleur talked with Jason Bordoff, head of Columbia University’s Center on Energy Policy, about the threat of cyber intrusion in the U.S. electric grid. LaFleur said while the digitization of the grid has broadened opportunities for new and innovative energy technology, it has in some ways made the grid more vulnerable.

It is potential cyber risks to the electric grid that worry LaFleur the most. The high-voltage interstate grid is, according to LaFleur, by far the most attacked infrastructure in the U.S., and new cyber threats are emerging and evolving with incredible speed. As LaFleur put it, would-be intruders attempt to penetrate the system daily.

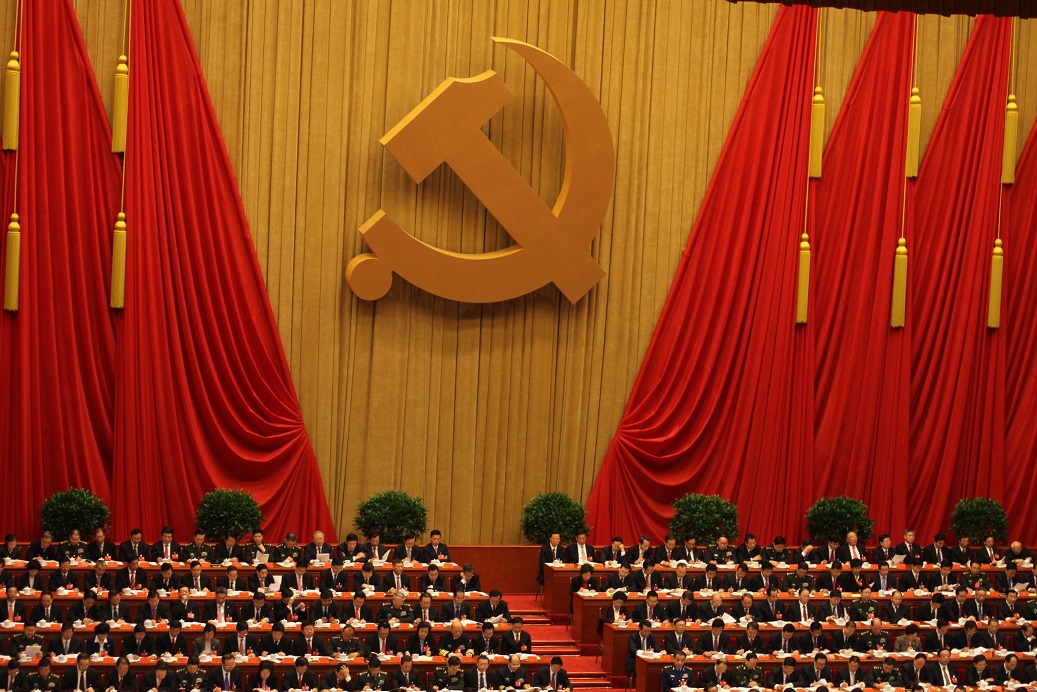

A Booz Allen Hamilton Industrial Cybersecurity Threat Briefing reports that cyber incidents targeting Integrated Control Systems (ICS), like the ones used to run the nation’s electric grid, reached an all-time high in 2015. The briefing also predicted that the number of these incidents will likely continue to increase, and cited nation-state backed groups as a key threat. Of these nation-state groups, Russia, China, Iran, and North Korea are all believed to be targeting the electricity sector, while Russia and China are also suspected of targeting oil and gas.

Hackers associated with nation-states are certainly not the only actors interested in energy targets. According to Hack Read, hacker group Anonymous reportedly targeted the Turkish energy firm Izmir Gaz, hacking into their website and stealing and leaking the personal data of customers, reportedly to protest Turkish President Erdogan’s crackdown on the media following a failed coup attempt earlier this month.

Coup Interrupted

Amid all the disruption of both the failed coup in Turkey and its brutal aftermath, one thing was not interrupted: energy transit. Turkish officials reported that during the coup, oil transit through the Bosphorous and Dardanelles, collectively know as the Turkish Straits, continued without interruption. The Straits are a major chokepoint for oil transit—one of the busiest in the world, according to the Energy Information Agency—and Bloomberg reported that "at least 10 crude tankers were signaling Turkish ports at the time of the attempted coup."

The tumultuous weeks following the coup may shake confidence in Turkey’s future role as a major conduit of energy trade. As Ed Crooks writes in The Financial Times, oil and gas supplies transit Turkey en route to consumers in Europe and elsewhere—and thus the security environment in the country is of keen interest for countries on the receiving end. Furthermore, as Natural Gas Europe writes, the leeway afforded to Erdogan under the three-month state of emergency could enable him to make deals and agreements in the energy sector.

The Panama Canal, LNG Futures, and Regional Rivalries

Following the opening of the newly-expanded Panama Canal last month, the first shipment of U.S. natural gas is expected to pass through the canal this week. According to Reuters, a tanker full of LNG from Cheniere’s Sabine Pass LNG terminal in Louisiana will transit the straits heading for the Pacific, raising expectations that the new route could raise the prospects of U.S. exports.

The route cuts in half the shipping distance from the Gulf of Mexico to Asia, reducing both time and costs for shipping to one of the world’s largest gas markets,. However, prospects for U.S. LNG exports to Asia have dimmed under current market conditions, as a supply glut has slowly eroded the attractive price differential between Asia and other markets.

All this puts into doubt previous predictions that the Panama Canal would be a game changer for US energy exports. However, while Canal’s impacts are still unclear, U.S. exports have reached a seemingly unlikely destination—the Middle East. According to The Financial Times, recipients of US LNG exports this year include Dubai and Kuwait, thanks in part to rising demand and energy consumption in the region.

Dubai and Kuwait aren’t alone. In Saudi Arabia, domestic energy demand is rising as electricity production struggles to keep up with the summer heat. And while Saudi Arabia is trying to maintain its oil production levels in order to not put further downward pressure on oil prices, it is drawing down its oil in storage. The Wall Street Journal reports that Saudi oil stockpiles reached the lowest level in nearly two years just last month.

Saudi Arabia relies heavily on crude oil for electricity production, reducing the amount available for export at a time when the country is trying to maintain market share—and keep regional rival Iran from edging in on its export markets.

In Brussels this week to promote the Kingdom’s Vision 2030 Plan, Saudi Arabian Foreign Minister Adel al-Jubeir went beyond discussing the Kingdom’s purported transition of oil to blame Iran for causing the problems plaguing the Middle East. As Politico EU reports, the Foreign Minister alleged that "Iran is on a rampage." This heated rhetoric is par for the course as the two countries continue to struggle both for oil market dominance and regional influence.

What to Watch

Cuba and Caracas

Amid expectations of economic growth, old fears of economic malaise may be resurfacing in Cuba. As The New York Times reports, the cost of fuel imports to the island are rising even while supply is falling. The economy is contracting, and the economy minister recently announced dramatic cuts in fuel consumption among other austerity measures would be necessary to stave off blackouts, harking back in the minds of many to the days of fuel rationing in the 1990s.

While it is unclear whether the current situation will inspire the same kind of reactions produced by electricity outages in the 1990s, Cubans are reportedly worried about a potential return to instability—and may be wondering who or what is to blame.

Blame Venezuela, says Raul Castro. Or more accurately, blame "certain contraction in the supply of oil contracted with Venezuela."

Venezuela reportedly supplies Cuba with approximately 80,000 barrels of oil per day under the terms of a 2000 agreement. However, Venezuela’s oil production hit a 13-year low last month, thanks to an economic crisis and the electricity blackouts currently roiling the country. Severe droughts caused an electricity crisis in Venezuela this spring as hydropower production was severely curtailed, leading to similar cuts in oil production—and exports to Cuba.

While rain has provided temporary relief—and restoration of electricity—Nick Cunningham warns in Oil Price that the worst may be yet to come. According to Cunningham, the Venezuelan oil sector is in desperate need of some TLC (think: repairs, maintenance, investment). However, falling oil revenues, spiralling inflation, and a worsening financial situation are not helping. Nor is a public-sector oil company that doesn’t pay its bills to partners, leading many operators to curtail or suspend their operations in the country.

As conditions on the ground worsen, so too could the security environment for operators already faced with intermittent electricity, unreliable partners, and aging infrastructure. And as companies pull back, production could continue to drop along with revenues, creating more problems and fewer resources in a country already on edge.