Hot Commodities: What Comes Down...

The rollercoaster ride continues as oil prices reached their highest point in 2016 at $40 per barrel this week — before slipping right back down again.

Published by The Lawfare Institute

in Cooperation With

The rollercoaster ride continues as oil prices reached their highest point in 2016 at $40 per barrel this week — before slipping right back down again. Many attribute the slight surge to increased confidence following the February 16 announcement of a tentative “agreement” between Saudi Arabia, Russia, and others.

However, many remain skeptical that the agreement — and the announcement of a follow-up meeting to be held in Russia later this month — will yield much fruit. (It also appears some producers, like the UAE, have yet to receive their invitation to the party.) As the Global Barrel’s Thomas O’Donnell points out in an interview with Sky News, there is little evidence to suggest that Russia will cooperate with Saudi Arabia in this endeavor and little incentive for any major producer to cut supply unless all producers are in on the deal.

More to the point, a production freeze is not the same as a production cut, nor would it have any impact of the oversupply currently on the market and in storage. As Art Berman argues in Forbes, a freeze would “only ensure that the supply surplus will not get worse,” giving the impression of doing something in lieu of actually taking action. According to Berman “Iran got this one right by calling it ridiculous.”

While this year’s theme thus far has been volatility, there are some analysts who see a light at the end of the tunnel. IEA analysts reportedly said prices appear to have bottomed out, and we can await the slow but impending recovery. UAE Energy Minister Suhail Al Mazrouei is betting on a slightly longer time horizon, predicting an oil price correction by the end of 2016.

However, the tunnel may not end soon enough for those in need of recovery now — including oil producers facing potential credit downgrades thanks to deteriorating balance sheets.

Moody’s announced it plans to review the credit ratings of ten major oil producing countries for a potential downgrade. The list includes usual suspects like Russia, Kazakhstan, Nigeria, Angola, Gabon, and Trinidad and Tobago, as well as Kuwait, Saudi Arabia, the UAE, Bahrain, and Qatar.

Oil-producing countries aren’t the only ones in Moody’s crosshairs — 11 local governments in Texas are also under review for potential downgrade, including school and hospital districts. This comes as the U.S. rig count dips below 400 for the first time since the 2008 recession. It remains to be seen whether and when what has gone down will in fact go back up.

Looking for a New Investment Opportunity?

In an interview with The New Yorker, US Special Presidential Envoy to the Global Coalition to Counter ISIL Brett McGurk explains, among other things, how the U.S. and allies developed and executed a strategy to hit the Islamic State where it hurts — its finances.

McGurk said estimates that the terrorist group was earning approximately $500 million annually from oil sales made the case for aiming at the group’s ability to produce and sell oil. While the strategy has seemingly paid off, McGurk said cutting of this source of revenue was a bit more complicated than “let’s just go out and bomb the trucks.”

According to McGurk, much of the information needed to uncover the various links in the oil supply chain was gathered during the attempted capture (and subsequent killing) of Abu Sayyaf, the group's former top financier in May of last year. The coalition bombing campaigns have thus far targeted oil fields and refineries as well as the trucks used for transport, and according to McGurk the terrorist group’s revenue from oil has since fallen nearly thirty percent (although historically low oil prices have probably contributed to this decline even as prices can be slightly higher in IS-controlled territory).

Perhaps indicative of just how successful the campaign has been (or just how desperate the group might be for cash — or oil traders for deals), The Financial Times reports that the Islamic State is offering licenses for oil traders who buy in bulk. According to FT, traders willing to brave coalition air strikes (and international opprobrium) can purchase licenses for up to 1,000 barrels at a time of IS oil — reportedly at a steep discount.

Another source of financing for the terrorist organization is fines, fees, taxes, and tariffs levied on populations under its control. According to a new report from the Justice for Life Observatory in Deir EzZor, The Impact of International Coalition Operations on the Economy of ‘Islamic State’ In Syria, the Islamic State focused on controlling territories that were resource rich and worked to centralize control and establish a tax system. While the report indicates that some taxes and tariffs have increased only marginally (electricity tariffs have risen by one dollar), others have increased dramatically — like irrigation bills, which doubled from around $12 to $25 per hectare.

The larger issue the report drives home is the degree to which these separate financing streams and administrative capabilities such as levying taxes relieve the group of the necessity of relying on external support and provide them with the trappings of statehood and an economy. It is precisely these characteristics, as McGurk pointed out, which must be targeted and degraded.

In the meantime, a ceasefire in the conflict has mostly held since the end of February, with peace talks tentatively set to commence in Geneva on March 14. However, as BBC put it, while many hope the spring thaw holds, at this point the truce remains “partial and imperfect, fragile and possibly fleeting.”

Denial of Service

While a different war may be waging in Ukraine, energy is similarly taking center stage.

A team of U.S. investigators concluded that the December 23 power outage in Ukraine was the result of a cyber attack — potentially making it the first cyber-induced blackout. For more on the attack itself, this assessment by SANS covers the different components of the attack while Wired has a more narrative recounting.

According to David Sanger in The New York Times, the attack is being regarded as a “teaching moment” for U.S. firms, playing on already heightened fears among energy utilities and grid operators about the vulnerability of energy systems to cyber attack (although not heightened enough, according to Ted Koppel). The Department of Homeland Security issued an alert from the Industrial Control Systems Cyber Emergency Response Team (ICS-CERT) which noted that not only were the attacks “synchronized and coordinated,” they probably came after “extensive reconnaissance of the victim networks.”

While utilities and grid operators claim they have, in cooperation with the federal government, taken steps to protect their systems, the near total reliance on computer-based control systems across the energy spectrum and supply chain from virtual trading hubs to SCADA systems to smart meters makes it hard to overstate the risk. The potential for cascading effects of a cyber attack, particularly in interconnected electricity markets in Europe and elsewhere make any attack scenario a fairly scary one, not to mention the fact that in Ukraine, power was restored thanks to the decision by utility staff to switch to “manual mode,” an option not available in countries with more technologically advanced grids.

International cooperation on protecting or ensuring the security of critical energy infrastructure from cyber attack is still in its nascent stages, and while the attack in Ukraine certainly galvanized domestic attention to the problem, it remains to be seen if an international frameworks, or platforms through existing institutions like the OSCE or NATO, can be formed to address the problem.

Meanwhile, Syria suffered a total electric blackout last week as all provinces lost power at once. While the cause remains undetermined, it further indicates the degree to which energy resources can be targeted in conflict, with economic, security, and humanitarian consequences. As a local doctor pointed out in an Amnesty International report on the alleged strategy of Russia and the Syrian forces to target medical facilities, “Hospitals, water, and electricity are always the first to be attacked.”

What’s (C)Old is New

Pipeline politics appears to be back in again as Russian efforts to maintain its European customer base while bypassing Ukraine lead to accusations of political maneuvering.

EU regulators approved the Trans-Adriatic pipeline last week, giving supporters of the Southern Corridor, the gas supply project which aims to bring Central Asian gas to Europe without the help of Russian interlocutors, something to cheer about. However, the project’s supporters are likely not as pleased with news that Gazprom signed an MOU with Greek and Italian firms to explore a potential gas supply route through the Black Sea.

According to Bloomberg, U.S. Special Envoy for Energy Affairs Amos Hochstein said Russian plans to build an additional pipeline to Europe, especially any which would give Russia the ability to end transit through Ukraine, are “politically motivated with little economic logic.”

However, Russia might not be the only one with political considerations in mind. Many U.S. officials have talked about and indeed welcomed the idea of U.S. LNG exports as a geopolitical tool. Writing in Foreign Affairs, SIPA Center on Global Energy Policy Director Jason Bordoff and co-author Akos Losz consider whether shale production has given the U.S. the opportunity to play the role of the “Benign Energy Superpower.” The authors assert that new LNG shipments “may well transform energy geopolitics in the years to come” as new supplies could increase the volume of the global LNG trade (in which Russia plays only minor role) fifty percent by 2020.

There are currently four U.S. LNG export terminals under construction, and the first U.S. LNG shipment set sail on February 24 from Sabine Pass. While expectation of the impact of U.S. LNG exports have run high, the U.S. Energy Information Administration warns that the energy landscape has changed since these projects were initially proposed and hence some expectation management might be required.

While shale and LNG exports continue to garner most of the energy headlines, David Koranyi at the Atlantic Council notes that it is just one of many trends shaping the contours of energy security. In a report on sustainable energy security, Koranyi points out that changing production and consumption patterns are blurring the lines between producers and consumers, resulting in new trade patterns and business models and a more complicated landscape of energy actors. Koranyi concludes that in the years to come the “role and importance of energy in international relations and especially great power relations will likely be a roller coaster ride.” This situation that may leave some longing for the days when lines were clear and alliances were simple.

What To Watch

The News from Erbil

For the Kurdistan Regional Government (KRG), the bad news just keeps coming. Following the disappointing revelation from Genel Energy that the KRG Taq Taq field contains only a third of the total oil initially thought (in case anyone was curious about Tony Hayward’s whereabouts since Macondo), the main pipeline used to transport KRG oil to market via Turkey has been cut off since February 16.

According to Keith Johnson at Foreign Policy, the “mysterious pipeline closure is bankrupting Iraqi Kurds” just when they can least afford it. As the KRG struggles to provide state services and continue their fight against the Islamic State with decreasing oil revenue, they have lost nearly $200 million from the pipelines closure. The reason for the closure is still unclear, though the Turkish government was quick to blame the PKK. Turkey announced it would begin repairs at the end of last month, and Reuters reports the pipeline should be up and running some time this week.

While the pipeline will likely be restored to full service, it leaves looming the larger question of how governments and countries in the region dependent on oil revenue can square the circle of falling revenue and rising spending on a war (or wars) that does not appear to be ending anytime soon.

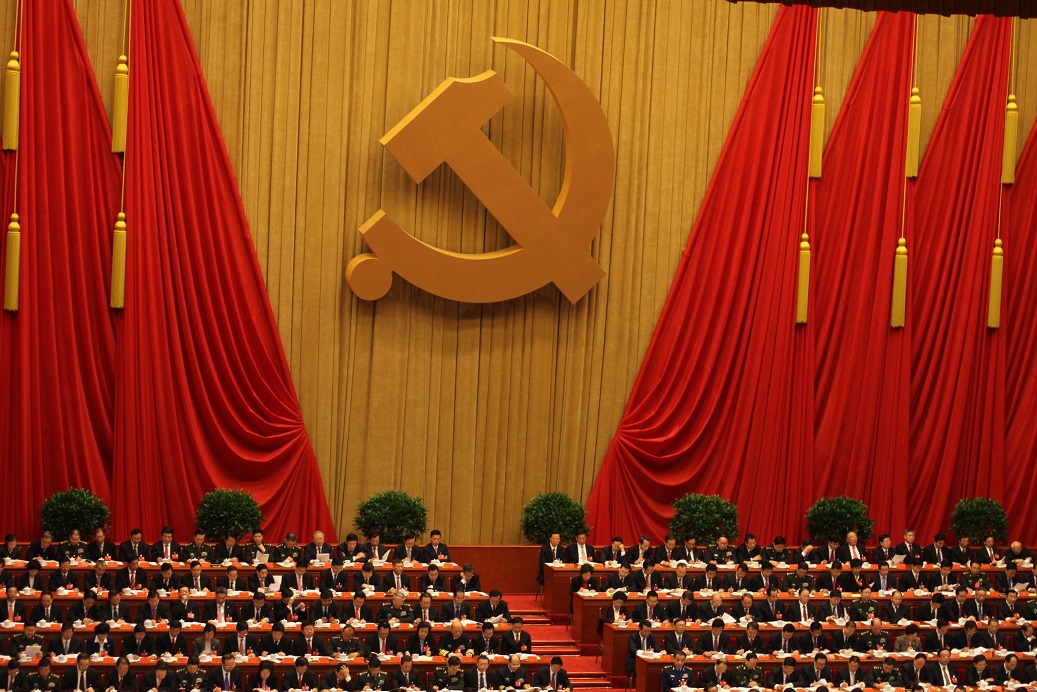

China Pumping the Breaks?

In more unwelcome news for energy producers competing to retain customers, China announced a cap on energy consumption as part of its 2016-2020 Five Year Plan. The Plan sets a maximum of five billion metric tons of standard coal equivalent of energy consumption by 2020. However, many experts say staying under the cap should be relatively easy to achieve. Total energy consumption was 4.3 billion tonnes of standard coal in 2015.

While previous plans have included caps on coal production, this is the first time an official cap on overall energy consumption has been included in a five year plan, potentially signalling the degree to which environmental concerns and the desire to increase the efficiency of energy consumption have converged as a priority for the Chinese Communist Party. We will wait and see if this commitment extends from word to deed.

Either way, the announcement comes amid the release of a study in the journal Climate Policy by Fergus Green and Lord Stern at LSE which supposes that Chinese emissions may have already reached their peak. While the Financial Times reported that such a possibility was rejected by China’s top climate adviser, the possibility of Chinese peak emissions are indicative of both Chinese intentions to transition away from coal as well as lagging energy demand linked to flagging economic growth. And it is the latter that keeps oil producers up at night.

The Odd Couple

While relations have been sour for a while now between the two former friends, the energy spat may worsen. Reports indicate that Gazprom, which supplies half of Turkey’s gas needs, abruptly cancelled a ten percent discount Turkey was receiving as part of its long-term contract, saying the discount is no longer valid. Turkish importers are refusing to pay their now-higher prices, and Turkish state owned energy company BOTAS is reportedly seeking alternative supplies for April.

Speculation abounds as to whether the dispute is commercial, political, enmeshed in the Syria conflict, or all of the above, and all of the theories seem to lead to more questions. As an article in Natural Gas Europe speculates, if the cut off is politically motivated, why now? And if the issue is purely commercial, why would Gazprom alienate a large customer like Turkey at precisely the time it is trying to rehabilitate its image as a reliable supplier? Taken in the context of the complicated pipeline politics taking place between the EU and Russia, the situation only becomes more complicated.