In Pakistan’s Financial Crisis, an Opening for Chinese Lawfare

Secretary of State Mike Pompeo argued last month that there was “no rationale” for allowing the International Monetary Fund (IMF) to divert “tax dollars” to Pakistan, since the IMF members’ funding, including that of the United States, would be used to bail out “China’s bondholders or China itself.” Pakistan is going through a grave financial crisis.

Published by The Lawfare Institute

in Cooperation With

Secretary of State Mike Pompeo argued last month that there was “no rationale” for allowing the International Monetary Fund (IMF) to divert “tax dollars” to Pakistan, since the IMF members’ funding, including that of the United States, would be used to bail out “China’s bondholders or China itself.” Pakistan is going through a grave financial crisis. Islamabad’s dollar reserves hover around $10 billion, barely enough to cover 100 days of imports. For Pompeo to use this moment to highlight Pakistan’s growing reliance on China may seem harsh. But his comments are accurate. And considered in context, it is clear that in “converting” Pakistan’s dollar dependencies into its own, China is taking a page out of an old American playbook.

Pakistan’s financial woes have been blamed on a number of factors: a poor tax base, an overvalued currency, declining exports and more. Should the country approach and receive assistance from the IMF, it would be the 13th occasion that Islamabad will have been bailed out by the fund. Pakistan faces a balance-of-payment crisis, meaning that the rate at which money is flowing out of the country—whether payments for goods and services, or other monetary transfers—consistently exceeds that at which it is entering the economy (such as through exports or investments). Pakistan has been in the red year after year due to increasing imports. Between 2005 and 2016, U.S. imports to Pakistan stayed virtually the same, around $5.5 billion annually. But in the same period, Chinese imports surged from $2.3 billion to $16 billion per year. So if Pakistan gets an IMF bailout, the odds are that such funds would help foot—however indirectly—a Chinese bill.

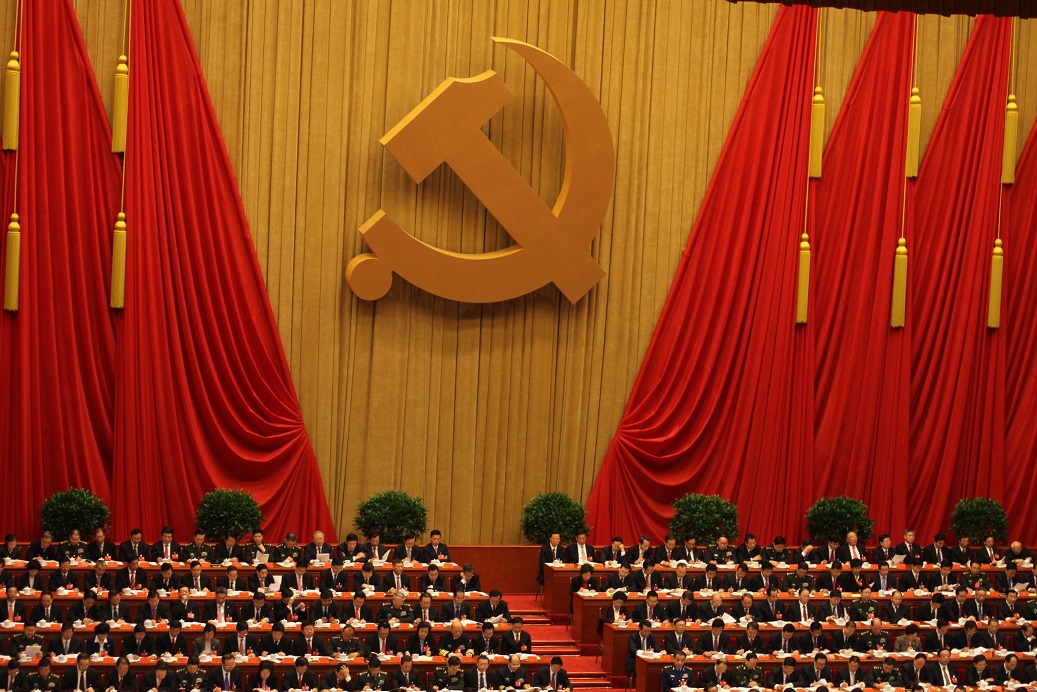

In response to Pompeo’s remarks, a Chinese foreign ministry spokesman said, “I think the IMF has its own standards and rules when it cooperates with relevant countries. I believe they will handle it properly.” It might seem, after China’s irresponsible lending to Pakistan, that this is a case of the proverbial devil quoting scripture. But international lawyers, students of international political economy and, of course, the U.S. secretary of state recognize the veiled references behind China’s statement. Over the past decade, Beijing has adopted a strategy like the one Dean Acheson pursued after World War II to capture a sizeable chunk of Britain’s share in world trade. Acheson led, among others, U.S. efforts to convert the sterling reserves of former British colonies into dollar dependencies, allowing the United States to become the driver of the global economic engine. What Acheson orchestrated, initially as assistant secretary of state and later as the top U.S. diplomat, was among the first instances of “lawfare” by the United States after the war. It resulted, among other things, in the creation of the Bretton Woods treaties and institutions that still manage the international financial order today. Already, China has created its equivalent of the World Bank: the Asian Infrastructure Investment Bank. But China does not yet control global monetary markets. If Beijing can “convert” Pakistan’s dollar dependencies—or, the extent to which Pakistan relies on international trade in U.S. currency and financing from U.S.-led institutions such as the IMF—into a reliance on Chinese currency and trade, it would also establish political influence over an American ally, echoing in many ways how the United States wrested influence from Britain after the Second World War.

Some further background explains how Chinese efforts today resemble ruthless American statecraft at the end of World War II. In 1945, Britain owed large sums of money to its colonies in the “sterling area,” a loose group of economies that traded in the British pound sterling. India, the U.K.’s main creditor, held at least $5 billion worth of sterling reserves from exports or services performed during the war. After India’s partition in 1947 into India and Pakistan, these reserves were distributed between both countries. During the war years, the sterling was fully convertible into dollars, but the use of dollar surpluses by colonies from trade with America was also capped. Through this monetary arrangement, Britain sought to exert continued political and economic control over its colonies. Unless absolutely necessary, all products had to be imported from within the sterling area, mostly from Britain.

After the colonies gained independence, all that changed. Britain’s production capacity was declining, and it could not meet the import requirements of infrastructure- and resource- hungry countries in South Asia. So India and Pakistan—which at the time included East Pakistan, or modern-day Bangladesh—relied increasingly on the United States for their food and industrial needs. Before World War II, British India imported nearly $175 million worth of capital equipment from the United States. Within several years, the volume of transactions between India and Pakistan and the United States had doubled.

But even as trade grew between Pakistan and the United States, restrictions on converting sterling to dollars were re-imposed by Britain. The issue required deft American diplomacy to increase its trade with former British colonies. Since the United Kingdom’s economy was itself in dire straits, Britain approached the United States for a multibillion-dollar loan in 1945. The Truman administration agreed, on the condition that sterling be made fully convertible.

Section 7 of the Financial Agreement between the Governments of the United States and the United Kingdom, 1945 read:

The Government of the United Kingdom will complete arrangements as early as practicable and in any case not later than one year after the effective date of this Agreement, […] under which immediately after the completion of such arrangements the sterling receipts from current transactions of all sterling area countries […] will be freely available for current transactions in any currency area without discrimination; with the result that any discrimination arising from the so-called sterling area dollar pool will be entirely removed and that each member of the sterling area will have its current sterling and dollar receipts at its free disposition for current transactions anywhere.

The Articles of Agreement of the IMF, adopted at Bretton Woods, prohibited London from restricting sterling convertibility for international transactions after 1951. The United States had argued that these provisions were necessary to foster multilateralism and free trade. But another important reason behind its push for convertibility was that the U.S. needed export markets for its growing economy. As Acheson said later: “In its simplest terms, the problem is this: […] how can Europe and other areas of the world obtain the dollars necessary to pay for a high level of United States exports, which is essential both to their own basic needs and to the well-being of the United States economy.” For Europe, these dollars came via grants and loans in the Marshall Plan; for South Asian countries, it was the reserves of sterling they had accumulated during the war. (China’s behemoth “Belt and Road Initiative” resembles this facet of the Marshall Plan—trillions of dollars are being lent by Chinese banking institutions to Asian and African economies along the “Belt” to buy Chinese goods and finance the building of infrastructure by Chinese corporations.)

Britain quickly reintroduced restrictions—with the tacit consent of the United States—on sterling convertibility, but there was no stopping the inevitable. India threatened to leave the sterling area if strict “dollar rations” were continued. In 1954, Pakistan loosened its restrictions on dollar imports, and by the end of the decade Britain’s volume of trade with Islamabad had declined nearly by half. The reason Pakistan let in American dollars at the time, interestingly, was its imminent balance-of-payment crisis.

Now, history is repeating itself. Like the United States after World War II sought to channel reserves of sterling into its own currency, China is pursuing a similar project in Pakistan through exports to the China-Pakistan Economic Corridor (CPEC). Beyond China’s own loans, the CPEC needs IMF dollars to stabilize Pakistan’s reserves and encourage Islamabad to take on more debt.

The analogy between the IMF bailout and the 1945 U.S.-UK agreement is not perfect: The IMF would offer loans that Pakistan will have to repay, in contrast to the sterling reserves it was owed after the war. And IMF funds would not be used to finance Chinese purchases directly but would head to Pakistan’s central reserves to stabilize its currency. Still, the underlying principle is the same: At the end of the Second World War, the United States wanted to take advantage of liquidity in the sterling area and convert it into favorable dollar trade. Now, China wants to take advantage of the global resources available to Pakistan from the IMF and transform it into renminbi dependencies.

Transactions between Pakistan and China are settled in dollars, but that is set to change. In December, Pakistan’s finance minister announced that all bilateral trade would be in local currencies, i.e., the rupee or yuan (the standard unit of the renminbi). Recently, Beijing extended a “currency swap” agreement with Pakistan to settle a greater volume of trade in renminbi. China’s policy planners have said they seek to “globalize” the country’s currency—and Pakistan is a laboratory for financial experiments to wedge the U.S. dollar out. It would be ironic if IMF dollars aid this purpose, just as sterling reserves were masterfully converted for dollar purchases after the war.

In the postwar era, Britain’s “special relationship” with the United States allowed London to reimpose restrictions on sterling convertibility soon after signing the 1945 agreement without objection from Washington. (The United States understandably worried about the UK economy going under if multiple countries depleted their sterling reserves at the same time.) Today, any demand by the United States that Pakistan limit its volume of trade with China would be anathema to Washington’s historical campaigns against market controls. The legacy of the Bretton Woods system includes reserving to Pakistan the prerogative to convert its currency into any foreign currency it wishes.

And China is counting on that. It is a risky strategy for China to pursue given that Pakistan’s economy is in the doldrums, but perhaps Beijing seeks more than economic dependency from Pakistan. In 1954, the year that Pakistan opened its economy to the U.S., Islamabad also signed the Manila Pact establishing the South East Asian Atlantic Treaty Organisation. The U.S.-Pakistan political and security relationship bloomed as Islamabad’s exposure to U.S. dollars increased. Beijing probably knows this, and if the past is any indication, that is where the China-Pakistan relationship is headed.