Semiconductor Investments Won’t Pay Off If Congress Doesn’t Fix the Talent Bottleneck

Including talent provisions in the final version of the House bill should be central to the U.S. strategy to reshore the defense industrial base and stay competitive with China.

Published by The Lawfare Institute

in Cooperation With

In the coming weeks, a conference committee will begin to hash out the differences between the House and Senate versions of major legislation to compete with China: the Senate’s United States Innovation and Competition Act (USICA) and the House’s America Competes Act. Both bills appropriate $52 billion to fund the Chips for America Act and reshore the semiconductor industry, but only the House bill includes critical provisions to provide the talent necessary to make sure these federal investments actually pay off.

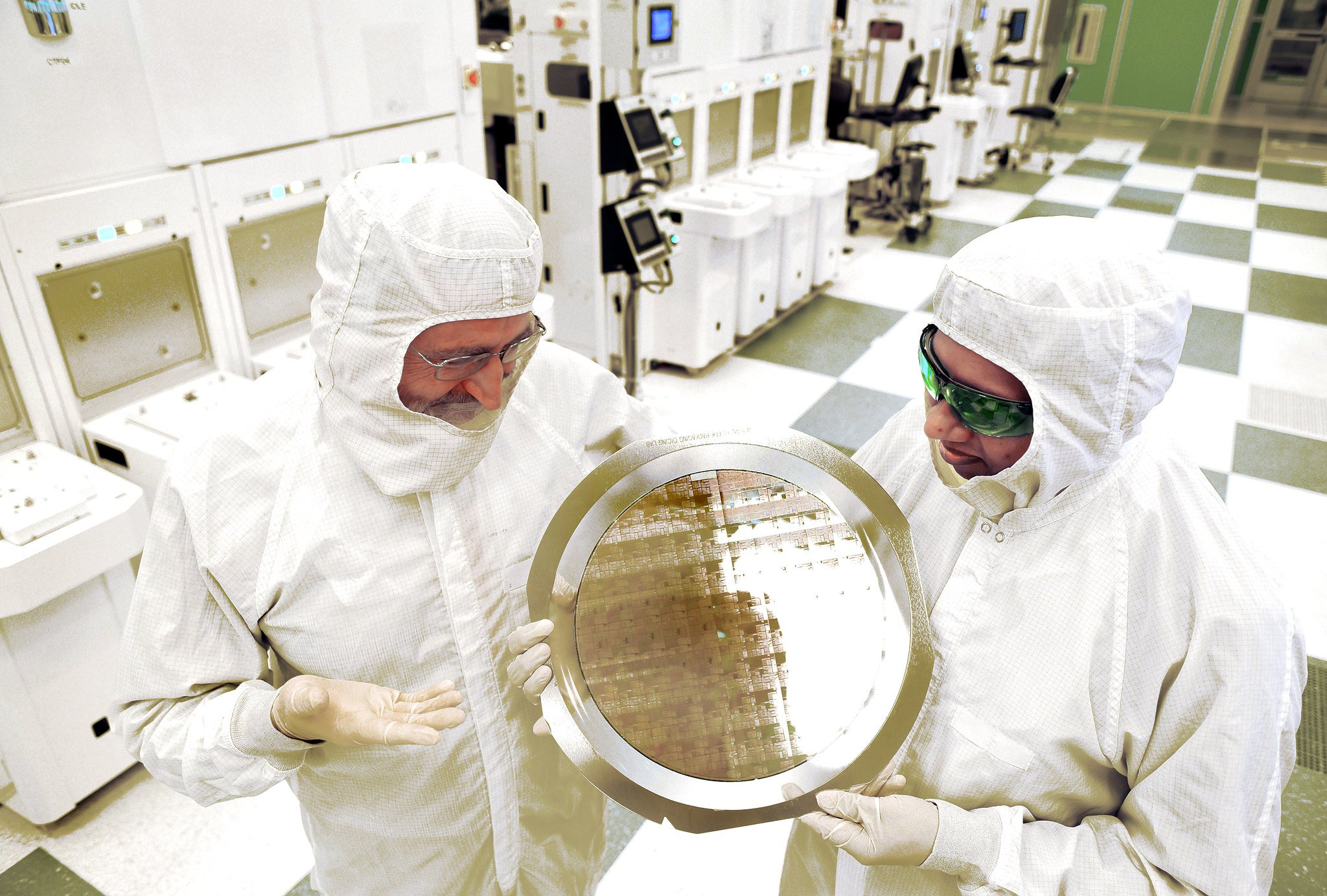

If these provisions are not included in the final bill, newly funded fabs will not be able to fill all of the necessary advanced STEM jobs in the face of persistent shortages of U.S. workers with the necessary expertise. In Arizona, where the Taiwan Semiconductor Manufacturing Company (TSMC) is building a new $12 billion dollar fab, progress has already been delayed by months because the company is having difficulty filling engineering jobs. Fortunately, both House and Senate versions of the legislation include investments in domestic STEM education, but this is a long-term strategy that will not yield dividends within the quick timeline that new plants need to be up and running.

Section 80303 of the House America Competes Act exempts STEM Ph.D. graduates from existing green card caps. It exempts STEM master’s degree graduates as well, provided they work in critical security-related industries like semiconductor fabrication. Currently, 50 percent of advanced STEM graduates in the defense industrial base are born abroad, and in semiconductor manufacturing specifically, the figure is 63 percent. Including these talent provisions in the final version of the bill should be central to the U.S. strategy to reshore the defense industrial base and stay competitive with China.

In 1990, the United States manufactured about 40 percent of the world’s semiconductors. Today, the country produces about 10 percent. Meanwhile, China not only intends to dominate the semiconductor market within the decade, but it also threatens the global supply of chips, over three-quarters of which are already produced in East Asia. The situation is even more risky with dynamic random-access memory (DRAM) chips, 93 percent of which are currently produced in Taiwan, South Korea and China. And, in the case of leading-edge logic chips, the United States simply doesn’t produce any.

A potential major disruption to the global chip supply chain posed by a belligerent China would risk a disaster. The United States cannot currently produce enough chips to cover even just the most sensitive applications, like the needs of the military, data centers and artificial intelligence. USICA and the America Competes Act can address this vulnerability, but only if the final legislation preserves the provisions that would ensure that new U.S. chip production has the highly trained labor it needs to succeed.

The Semiconductor Industry’s Need for International Talent

The Chips for America Act, the centerpiece of the competitiveness legislation before Congress, aims to significantly reduce U.S. dependence on foreign-produced chips by providing tens of billions of dollars in incentives for companies to ramp up production at domestic foundries. But direct funding can go only so far without addressing labor supply constraints. Most importantly, capacity will be held back by STEM talent shortages that a Department of Defense report recently concluded are “quickly approaching crisis status” in the defense industrial base.

Industry insiders report that “the talent shortage is the most critical issue confronting the semiconductor industry today.” American Community Survey (ACS) data show that nearly five times as much of the industry’s workforce requires an advanced STEM degree as in other industries, which helps explain why STEM talent shortages plague semiconductor manufacturing.

In 2021, Morris Chang, the founder of TSMC, identified talent shortages as the major challenge to opening fabs in the United States instead of Taiwan, which has a deep pool of extremely qualified talent devoted to the chip sector. Chang reiterated the point in April, explaining that “Taiwan has certain competitive strengths in semiconductor manufacturing. Those strengths are … almost entirely people related—talent related” and that the “major limitation” to ramping up U.S. production is “a lack of manufacturing talent.”

Federal spending can address some of the financial concerns for a company deciding whether to open a facility in East Asia or the United States, but only immigration policy has the potential to unlock the hard constraints on talent. Zero-sum competition for talent among TSMC, Intel and Samsung is already slowing existing plans for growing the U.S. industry. Such delays will only be exacerbated by new fabs unless the talent pool can be broadened.

Recent findings by the Center for Security and Emerging Technology (CSET) suggest that there is “insufficient semiconductor manufacturing talent latent in the U.S. workforce” to meet the labor needs of new fabs funded by the Chips for America Act. The bill is predicted to grow the overall semiconductor workforce by 13 percent, with growth concentrated in high-skilled engineering roles, which are expected to grow by 19 percent. The report finds that the existing shortfall of talent means that “the success or failure of CHIPS Act incentives may depend in part on … firms’ ability to gain visas.”

The electronic component manufacturing industry is heavily reliant on international talent. ACS data show that from 2015 through 2019, 75 percent of STEM Ph.D.s employed by the industry in the United States were born abroad, as were 60 percent of STEM master’s graduates in the industry. This makes the industry more than nine times as reliant on international talent with advanced STEM degrees as in other industries. With the highly technical work involved, the vast majority of workers with the necessary experience are outside the United States.

Workers with industry-specific knowledge and experience are crucial. As the Semiconductor Industry Association explained to the National Institute of Standards and Technology in 2018, experienced workers are vital for new fabs because “new recruits often lack the skills to ‘hit the ground running.’ ... Many students graduating from U.S. colleges and universities with excellent general engineering or computer science skillsets often lack industry specific skills and the broader set of ‘soft skills’ required to work effectively.”

The CSET report finds that even with significant recruitment from other industries and from academia, thousands of new jobs will remain vacant unless the industry is empowered to recruit top talent from abroad. This is especially the case for cutting-edge fabs pushing the technology forward, which require collaboration by top engineers from around the world.

Immigration Reforms Complement Domestic Upskilling

In the short and medium terms, recruiting international talent with the necessary skills and experience is important for jump-starting the flagging U.S. chip industry. But in the long term, the health of the industry and the rest of the defense industrial base is also dependent on domestic U.S. STEM education. To that end, both the House and Senate versions of the bill include more than $8.4 billion in funding for STEM education efforts. Including immigration provisions would make this spending go further by helping to train a domestic workforce and reducing the cost of domestic STEM education.

First, every cap-exempt immigrant is required by the provisions to pay $1,000 to fund STEM scholarships and training for low-income Americans. What’s more, new STEM immigrants will directly contribute to the training of Americans. While many jobs need to be filled by industry veterans, workers in entry-level jobs do not yet have the implicit knowledge of experienced semiconductor professionals. They will need to learn from workers who have hard-won knowledge from having worked in cutting-edge fabrication plants. Recruiting the top talent from Taiwan, Korea and around the world today would facilitate the training of the next generation of top semiconductor talent in the United States.

In addition, cap-exempt STEM Ph.D.s will help educate the future STEM workforce. By increasing the supply of qualified STEM professors, cap exemptions would also reduce the cost of domestic STEM education.

Further, the cap exemptions would expand international STEM enrollment in the United States, which expands education opportunities for native-born Americans. Research shows that foreign students don’t crowd out U.S. citizens; rather, foreign enrollment boosts domestic enrollment because international students—who pay out-of-state tuition—effectively subsidize the tuition of others. The number of international students in U.S. universities was decreasing even before the coronavirus pandemic, which then prompted a steep decline in international enrollment. Nevertheless, international students still represented more than half of all advanced STEM graduates in recent years. While countries like Canada have proactive international education strategies to attract international students, the United States does not have any clear plan to reverse the recent collapse of foreign enrollment. Cap exemptions would be a strong start by making a U.S. degree more attractive by attaching immigration opportunities.

Domestic STEM education and training are worthy investments, but international recruitment will be an important complement for the foreseeable future. The United States will need to rely on both because China’s population is so much larger. China already graduates more STEM Ph.D.s and master’s graduates each year than the United States, even though the United States still leads as a percentage of its population. And, for every percentage point that China increases its STEM share of the workforce, the United States would have to increase its own by four times as much to keep up.

Fortunately, STEM immigration and STEM education are mutually reinforcing. More of the former will yield more of the latter. What’s more, because highly skilled STEM immigrants work in such specialized roles and improve the productivity of their American colleagues, they tend to complement the domestic workforce more than compete with them. STEM immigration has been found to raise the wages of similarly educated Americans even more than it raises the wages of Americans in other sectors.

And the benefits aren’t limited to Americans with or pursuing STEM degrees. Alleviating bottlenecks caused by shortages of high-skilled STEM talent means that a plant can also employ many people in supporting roles. For every job in the electronic component industry needing an advanced STEM degree, ACS data show that there are five jobs that do not. Workers in those jobs are not eligible for the cap exemptions under the bill and most are native-born Americans. High-skilled immigrants complement the U.S. workforce, especially in semiconductors, and are likely to create more opportunities that will grow the U.S. economy.

Conclusion

National security experts who have reviewed the semiconductor situation have converged on international talent as a key area for reform. The National Security Commission on Artificial Intelligence, the GOP China Task Force, the bipartisan Future of Defense Task Force, and the President’s Council of Advisors on Science and Technology have all published reports identifying semiconductors as a critical need for U.S. national security and international talent recruitment as a vital part of any strategy to promote U.S. leadership. The artificial scarcity of semiconductor talent is already a major challenge in growing U.S. semiconductor capacity and will only get worse if the U.S. funds new fabs without expanding the talent pipeline. High-skilled STEM immigration will be necessary for success.

.jpg?sfvrsn=8588c21_5)

-final.png?sfvrsn=b70826ae_3)