SinoTech: Chinese Telecoms Face Continued Scrutiny in the U.S.

The new year has not brought Chinese telecommunications firms any relief from scrutiny from U.S. lawmakers and law enforcement officials. On Jan. 16, Sens. Tom Cotton (R-Ark.) and Chris Van Hollen (D-Md.) introduced the Telecommunications Denial Order Enforcement Act in the Senate, while Reps.

Published by The Lawfare Institute

in Cooperation With

The new year has not brought Chinese telecommunications firms any relief from scrutiny from U.S. lawmakers and law enforcement officials. On Jan. 16, Sens. Tom Cotton (R-Ark.) and Chris Van Hollen (D-Md.) introduced the Telecommunications Denial Order Enforcement Act in the Senate, while Reps. Mike Gallagher (R-Wisc.) and Ruben Gallego (D-Ariz.) introduced the same bill in the House. The proposal would prohibit the sale of U.S. components—namely microchips—to Chinese telecommunications companies found in violation of U.S. export control and sanctions laws. In addition to enshrining a policy of enforcing “denial orders banning the export of U.S. parts and components,” the bill would also prevent executive agency officials from modifying the penalties imposed on Chinese firms or withdrawing them until a pattern of compliance was established.

The bill primarily appears to target Huawei and ZTE, two of China’s biggest telecom companies, which have recently made headlines for sanctions violations. In June 2018, after ZTE broke a settlement agreement regarding sales to Iran and North Korea in violation of U.S. sanctions, the company agreed to pay the United States a $1 billion fine in return for lifting an export ban on components from U.S. firms. The Trump administration’s decision to lift the ban may be the type of modification or withdrawal the new bill seeks to address. Additionally, in December 2018, Huawei Chief Financial Officer Meng Wanzhou was detained by Canadian authorities at the request of the United States in connection with investigations into Iran sanctions evasions by the company. Meng, seen as the company’s “polished, professional face,” is the daughter of Huawei founder Ren Zhengfei. In introducing the bill, Sen. Cotton said,

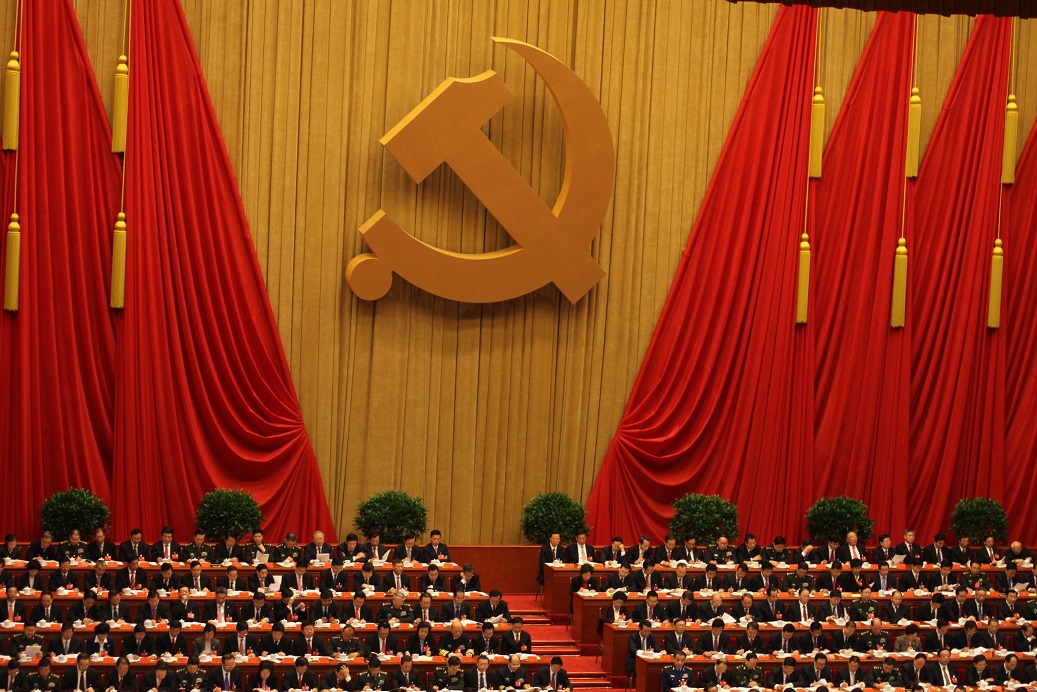

Huawei is effectively an intelligence-gathering arm of the Chinese Communist Party whose founder and CEO was an engineer for the People's Liberation Army … If Chinese telecom companies like Huawei violate our sanctions or export control laws, they should receive nothing less than the death penalty—which this denial order would provide.

In addition to congressional activity, the Wall Street Journal reported last week that federal prosecutors are criminally investigating accusations that Huawei stole trade secrets from American companies. The allegations focus on whether the company stole robotics technology for testing smartphones developed by T-Mobile while the two firms were in a business relationship. This dispute was previously the subject of a civil lawsuit that ended in 2017, in which Huawei was found liable and forced to pay $4.8 million to T-Mobile.

Chinese officials have been quick to criticize recent U.S. actions. On Jan. 17, a spokeswoman for the Ministry of Foreign Affairs announced, “People around the world all know very well the true intention of the U.S. using every possible state apparatus to suppress and block Chinese high-tech companies.” Huawei’s negative press has also led the company’s founder, Ren Zhengfei, to speak out. In an interview with foreign media on Jan. 15, he explained, “If a small number of countries decide to no longer buy Huawei products, then we will [shift our focus to] better serve those countries who are fully happy to buy our equipment. We will build our networks to prove we are worth trusting.” Although Ren described Huawei as merely “a small sesame seed” in the scope of the U.S.-China relationship, the company appears to have taken on outsized importance of late.

European Union members reveal more unified front on China

On January 11, Polish authorities arrested Wang Weijing, a Huawei sales director, as well as Piotr Durbajlo, a Polish cybersecurity expert, charging both with espionage. Polish governmental sources have so far refused to divulge further information on the arrests. Huawei was quick to disavow Wang, firing him the next day and proclaiming that his actions had “no relation to the company.” Though Polish authorities have not yet charged Huawei with any wrongdoing, several European Union members have announced deeper scrutiny of Huawei technology since the arrest.

A Polish government official told Reuters several days after the arrest that Poland could well “tighten legislation” to limit the availability of Huawei products in the country. More concretely, Poland’s internal affairs minister called for the EU and NATO to work out a “joint position” on whether or not to ban Huawei products. Earlier this month, the Norwegian government revealed that it too was considering whether to ban Huawei from developing the country’s 5G network. And in a sharp policy turnaround, Germany has followed Poland’s lead and is likewise considering a Huawei ban. At the end of last year, Germany indicated that it would not exclude Huawei from its 5G auction.

This heightened scrutiny of Huawei comes as key EU member countries explore more robust ways of responding to the Chinese challenge. The New York Times revealed in December that hackers had listened in on European diplomatic cables for several years; analysts have since linked the operation to Chinese hackers, and EU organizations have scrambled to overhaul their communications systems. EU officials have also implemented proactive measure: In December, the EU expanded the scope of its complaints to the WTO about China’s technology transfer practices. Almost concurrently, the EU introduced a joint framework on screening foreign investment that will allow members to share information on investments that carry a national security significance. The slew of new measures has led at least one commentator to argue that EU-China relations will “face a bumpy road” in 2019.

Still, the EU and many of its member states have yet to settle on a fully unified response on other issues. Germany, despite its renewed scrutiny of Huawei, recently signed a number of bilateral agreements with China pledging deeper financial cooperation. Moreover, in a landmark meeting on Jan. 15, members of the European Commission debated a proposed merger that would see German firm Siemens and French firm Alstom combine their rail assets. The German and French governments have argued that such a merger would allow Europe to compete with Chinese train maker CRRC. But Margrethe Vestager, Europe’s antitrust chief argued that a weakening of European antitrust legislation was not an appropriate solution, adding that the EU ought to consider other initiatives to counter unfair Chinese trade practices. The European Commission will need to make a final decision on the merger by Feb. 18. Though the commission is likely to block the deal, the key issue motivating the proposed merger—how Europe ought to deal with an economically powerful China—will not go away any time soon.

In Other News ...

- The Chinese Ministry of Commerce announced that Vice Premier Liu He would visit the United States on Jan. 30-31 to continue trade talks. Additionally, Bloomberg reported that during trade talks earlier this month in Beijing, Chinese negotiators offered to increase U.S. imports over the coming six years so that by 2024 China’s trade surplus with the United States would fall to zero from a peak of $323 billion in 2018. However, simply increasing U.S. imports neither alters the contributions to the trade deficit from U.S. demand for Chinese manufactured goods, nor addresses Chinese trade imbalances with other nations. It also does not address structural issues such as state-backed intellectual property theft and technology transfer policies.

- A new unclassified report from the Defense Intelligence Agency on Chinese military power highlights the People’s Liberation Army’s military modernization including the development of more agile power-projection capabilities. DIA emphasizes recent advancements in military technology, including “space and cyberspace assets” and missile systems.

- According to the Wall Street Journal, attention devoted to a potential new Chinese foreign investment law has mounted with the lengthening of the U.S.-China trade war. The Standing Committee of the National People’s Congress, China’s national legislature, will meet on Jan. 29 and 30 to review the draft law for a second time before potentially considering a final draft during the annual full legislative session in March. The new law would prohibit forced technology transfer from foreign companies, but many businesspeople argue the current draft is too vague and lacks adequate implementation mechanisms.

- Following the successful landing by China’s Chang’e-4 spacecraft on the far side of the moon on Jan. 3, the China National Space Administration announced plans for another moon mission in 2019 as well as a Mars exploration mission around 2020. NASA also announced that it “has been in discussions with China to explore” collaboration on certain moon-exploration activities and had received the approval of Congress for such discussions, which is required for exceptions to the ban on NASA’s using federal funds for any work with China or Chinese-owned firms.

- Sens. Bob Menendez (D-NJ) and Marco Rubio (R-Fl.) reintroduced the Uyghur Human Rights Policy Act of 2019 this week, which advocates targeted sanctions against Chinese government officials linked to the detention of nearly one million Uyghurs—a Muslim ethnic minority group—in the autonomous region of Xinjiang. Chinese officials have employed different technologies to facilitate repression in the region, including widespread video surveillance and DNA collection. The bill calls for a report from the director of national intelligence that would address “the transfer or development of technology used by … China that facilitates the mass internment and surveillance of Turkic Muslims, including technology relating to predictive policing and large-scale data collection and analysis.”

Commentary

As the fallout from Canada’s arrest of Huawei CFO Meng Wanzhou continues, commentators have addressed the significance of China’s increasingly belligerent behavior. On Jan. 14, a Canadian man, Robert Schellenberg, was sentenced to death for drug trafficking. Previously, he had been sentenced to 15 years in prison for shipping methamphetamines to Australia, but he was then retried in what many are interpreting as a direct response to Meng’s arrest. The Economist argued that the Chinese government is signalling that the “gloves are off.” On Lawfare, Donald Clarke analyzed unusual legal features of the case, including the “extraordinary delay in trial and sentencing,” ultimately describing China’s actions as “hostage diplomacy.” Similarly, Tom Kellogg, also writing for Lawfare, warns that the Huawei episode as well as China’s increasing use of exit bans indicates a willingness to use “foreign nationals as bargaining chips.” Last, Samm Sacks and Paul Trioli appeared on the Sinica Podcast, contextualizing the Huawei episode within broader trends in the global telecommunications industry.

Recently, a slew of commentators have analyzed the successes and failures of Chinese soft power. An op-ed in the South China Morning Post argued that China continues to fall short of its goal of “winning hearts and minds” and that China’s soft power tactics have “run into a wall.” In the field of higher education, a recent essay revealed that at least 10 American universities have moved to shut down their campuses’ Confucius Institutes in the past year alone. A Washington Post piece argued that Confucius Institutes are key to Beijing’s effort to improve the “portrayal of China abroad,” but also noted that the “overall global media tone about China has become markedly more negative.” Finally, in an interview with China.org.cn, Joseph Nye, the father of the concept of “soft power,” advised China to continue focusing on refining its soft power, which remains a necessary complement to its growing hard power capabilities.

Finally, analysts examined the past and future of the U.S.-China trade war following trade talks at the beginning of this month. In an exclusive interview with the South China Morning Post, Hong Kong property tycoon Ronnie Chan argued that Chinese negotiators failed to understand that Trump, at the beginning of his administration, “did not want a deal.” Expressing guarded optimism about the future of the U.S.-China relationship, Chan argued that Trump could be forced to make a deal if he faces enough political or economic pressure at home. Other pieces have analyzed economic stresses that could lead the Chinese government to introduce more concessions. A SCMP editorial argued that Beijing’s recent introduction of stimulus measures would likely lead to stability in the “foreseeable future” but that a “growth recession” was likely to last for many years. Others have questioned whether optimism on the trade war is well founded.