Sinotech: Trade Negotiations Continue While China Scales Up Tech Regulation

China and U.S. restart trade negotiations

Published by The Lawfare Institute

in Cooperation With

China and U.S. restart trade negotiations

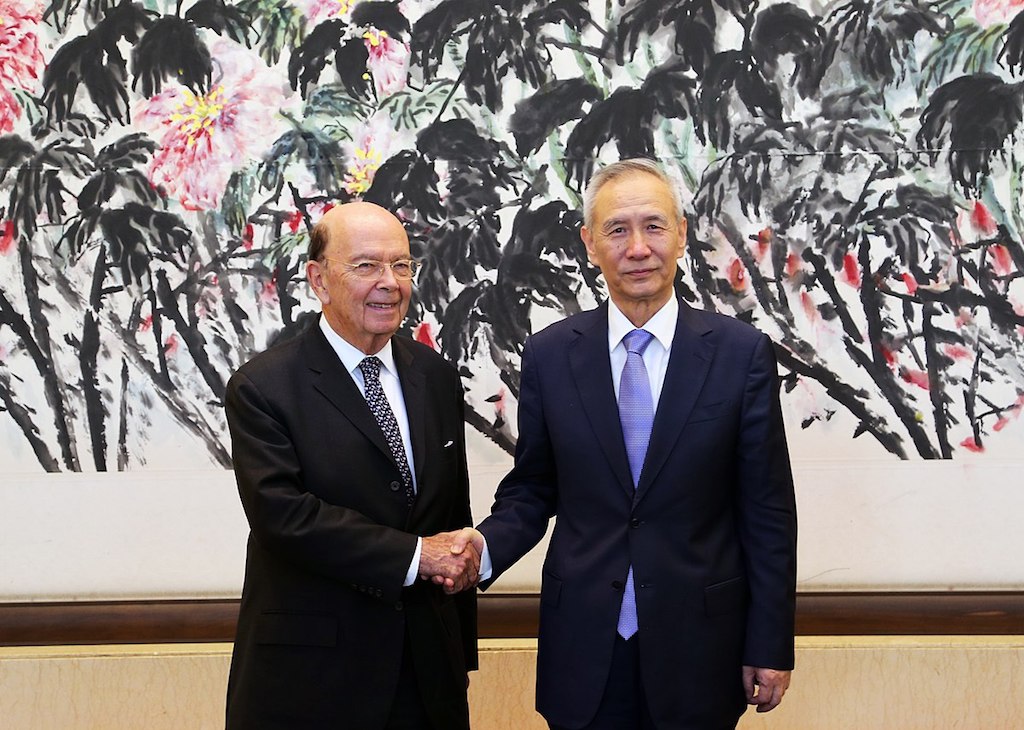

A Chinese trade delegation has arrived in Washington to participate in negotiations Wednesday and Thursday with American counterparts in the latest attempt to head off escalating tariffs and ease tensions in the two countries’ emergent trade war. The discussions will mark the first official U.S.-China trade dialogue since early June, when discussions between Commerce Secretary Wilbur Ross and Chinese Vice Premier and economic czar Liu He broke down in Beijing. But neither Liu nor Ross will be present at this week’s meetings; instead, negotiations will be led by David Malpass, the under secretary of the Treasury for international affairs and a staunch supporter of President Trump’s trade policies, and Chinese Vice Minister of Commerce Wang Shouwen, an official noted for his hostility towards American trade policies.

The comparative downgrading in the ranks of the officials involved suggests little potential for substantive negotiation, and reports indicate that this week’s talks will mainly explore the possibility of future discussions among more senior members of government—likely a return to talks between Liu and Ross or other senior American officials such as U.S. Trade Representative Robert Lighthizer or Treasury Secretary Steven Mnuchin, both of whom last participated in official negotiations in early May. In order for those talks to take place, the White House is reportedly demanding that the Chinese government indicate willingness to reduce the trade deficit, reduce import tariffs, and strengthen intellectual property protections. Those demands reflect an administration confident in its negotiating position. Chinese officials now reportedly view the Trump Administration’s trade policies as part of a long-term strategy to stymie China’s economic and political rise, which may make a bargain more appealing to those officials. But this week’s negotiations are also reportedly part of a larger plan to negotiate an end to the trade conflict by November, when Presidents Xi and Trump will meet at two high-profile international conferences.

In the months since the last set of talks fell through, the trade conflict has escalated by leaps and bounds. The United States imposed tariffs against the first $34 billion of $50 billion in targeted Chinese imports in early July and is scheduled to impose the final $16 billion tomorrow; public hearings on an additional $200 billion in tariffs are currently ongoing. The Chinese government has generally responded in kind, although the limited overall quantity of U.S. exports to China has prevented it from threatening equivalent tariffs against the $200 billion American threats. A November trade agreement likely would not head off those tariffs on $200 billion of goods, which are expected to be implemented in late September. But it would likely avert Trump’s threat to impose tariffs against all Chinese imports to the U.S., which has not yet been formally proposed or subjected to notice and comment procedures.

China continues to intensify regulation of mobile apps and video games

Chinese regulators have tightened their grasp on mobile apps and video games, most notably by suspending the operating license for “Monster Hunter: World,” a major game launched domestically by internet giant Tencent, because it “did not meet regulatory requirements.” Tencent’s shares on the Hong Kong stock exchange plunged 10 percent in four days earlier this month, after the company announced second quarter profits down two percent from a year earlier. Martin Lau, Tencent’s president, attributed the drop to difficulties in obtaining approval for new games since the National People’s Congress voted to shift responsibility for some forms of media regulation to the Chinese Communist Party’s Publicity Department in March. Sources attributed the removal of “Monster Hunter” to bureaucratic infighting as the Publicity Department seeks to establish authority over the subject.

Tencent is not alone; shares of other Asian video game producers also dropped last week after regulators announced a temporary stop on new approvals. Developers including Capcom, which develops “Monster Hunter: World,” Nintendo, Konami and Square Enix all saw drops of at least four percent. Other Chinese tech stocks in Hong Kong also suffered significant declines, fuelled by the Tencent sell-off.

The Chinese government has also asserted firmer control over the content of mobile phone apps, most recently by requesting that Apple pull illegal gambling apps from its Chinese App Store. Apple promptly complied with the request by removing 25,000 infringing apps, or roughly 1.4 percent of the all apps available in China. The American firm has clearly adjusted to such demands; it promised to cut down spam on its iMessage platform earlier this month after Chinese state media castigated Apple’s tolerance of iMessage spam and illegal content, such as gambling apps, on its devices. Last year, it was heavily criticized for removing VPN apps that would allow users to circumvent the “Great Firewall” from the Chinese App Store.

In Other News

- On August 9th, Vice President Pence announced a strategy to establish Space Force as a sixth branch of the U.S. military, a plan that administration and defense officials have repeatedly described as necessary due to threat posed by Russian and Chinese weaponization of outer space. China’s military strategy in space is largely determined by the Strategic Support Force, a division of the People’s Liberation Army created in 2015 to consolidate informational that also manages cyber operations and electronic warfare. For a more in-depth look at China’s military objectives in space, see this 2017 Rand report.

- Hundreds of Google employees have signed an internal letter demanding greater transparency after the company’s ambitions to re-enter the Chinese market with a censored search engine were revealed by The Intercept earlier this month. During a subsequent weekly all-staff meeting, Chief Executive Sundar Pichai assured employees that Google was “not close” to launching the search engine, and stated that it was “very unclear” whether the search engine would be launched at all. The People’s Daily, a Chinese government mouthpiece, commented earlier this month that Google is welcome back to mainland China as long as it complies with laws and regulations, though the censored search engine is not expected to win regulatory approval in the immediate future.

- A new report by American cybersecurity firm Recorded Future has traced cyber attacks against numerous governments, non-governmental organizations, and corporations to infrastructure owned and operated by Beijing’s elite Tsinghua University. The timing of the attacks consistently corresponded to Chinese government engagement with the victims of the attacks, leading Recorded Future to judge with “medium confidence” that the attacks were carried out by Chinese state-sponsored actors. The hackers only conducted network reconnaissance operations, and do not appear to have obtained any confidential documents. Chinese universities have been linked to offensive cyber operations in the past, and the Chinese Cyberspace Administration and Ministry of Education announced last August that it would identify four to six key universities to train a new generation of cybersecurity professionals.

- Trump signed the 2019 National Defense Authorization Act (NDAA) on August 13, ratifying the Act’s revisions to the Committee on Foreign Investment in the United States (CFIUS) approval process and restrictions on government procurement of Chinese tech products, among other provisions. China’s Ministry of Commerce immediately objected to the portions of the act that strengthen CFIUS review, warning that “[t]he US should treat Chinese investors in an objective and fair way and prevent the review from blocking cooperation in investment.”

- Redcore, a Chinese start-up that claimed to have developed a purely China-owned browser used by government agencies and state-owned companies, was heavily criticized after user testing discovered that the software had been based on Google’s Chrome browser. The revelation came a day after Redcore announced $36 million in new funding, including funding from government bodies and state-owned enterprises. The company apologized in a public letter for its exaggerations during the recent fundraising.

Analysis & Commentary

A spate of recent Lawfare articles have examined developments in U.S. technology and defense policy. Scott R. Anderson, Sarah Tate Chambers, and Molly Reynolds summarize the contents of the National Defense Authorization Act (NDAA), including the reform of rules regarding foreign investment in U.S. companies and authorization for retaliatory cyber attacks, as well as several China-specific provisions. Robert Farley examines the arguments and counterarguments for establishing a Space Force as a sixth branch of the U.S. military. Bobby Chesney explains the Trump administration’s recently unveiled policy for pursuing offensive cyber operations.

At the Brookings Institution, David Dollar inspects how a sustained trade war might shift the recipients but otherwise not affect America’s trade deficit, and Ryan Hass has published a policy brief on “[p]rinciples for managing U.S.-China competition.” At The Diplomat, Jin Kai suggests that the Trump Administration’s trade machinations may reflect a strategy to push its relationship with China to a “grey zone” between war and peace; Chuzi Xiao argues that Facebook’s attempts to enter the Chinese market are “doomed to fail”; and Bonnie Girard details early congressional pushback against Google’s plans to relaunch its search engine in China. At the Peterson Institute for International Economics, Martin Chorzempa argues that the watered-down amendments to the CFIUS process passed in the NDAA offer an acceptable balance between technological innovation and national security.

In Foreign Affairs, Adam Segal outlines the Chinese government’s strategic effort to remodel the Internet and develop technologies in its own image; Michèle Flournoy and Michael Sulmeyer, more optimistically, present “A Plan for Securing Cyberspace.” In the Wall Street Journal, Weijian Shan suggests that the Trump Administration could achieve its trade war objectives by favoring the reformers among Beijing’s leadership. For NBC, Robert Z. Lawrence concludes that the Trump administration’s ultimate objective from a trade war is the imposition of long-term tariffs on Chinese goods. And in Foreign Policy, Abigail Grace explains how the Chinese government’s technological policy plays into its ambitions to rewrite the international order.