SinoTech: Trump Administration Moves to Cut Off Huawei from U.S. Components and Networks

Published by The Lawfare Institute

in Cooperation With

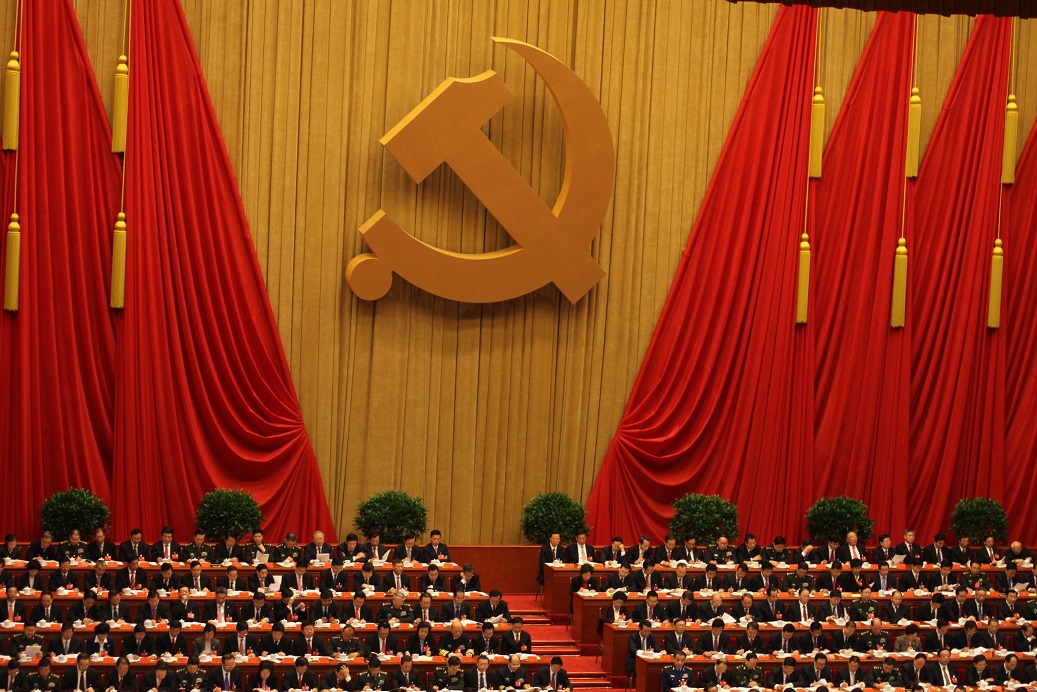

On May 15, the Trump administration escalated its feud with the Chinese telecommunications company Huawei by issuing an executive order that declared a national emergency with respect to telecom infrastructure security and that laid the groundwork for the commerce secretary to prevent U.S. companies from installing any “information and communications technology or services designed, developed, manufactured, or supplied, by persons owned by, controlled by, or subject to the jurisdiction or direction of a foreign adversary” and that “poses an unacceptable risk” to U.S. national security. While the executive order did not name Huawei, and though the White House claimed the order was “agnostic,” the long-anticipated decision was widely interpreted to be targeted at the Chinese company. At the same time, in a move with major ramifications for global tech supply chains, the Commerce Department placed Huawei and 68 affiliate companies on a list of companies to which U.S. firms may not sell components without government approval. Such export license applications will be subject to a “presumption of denial.”

In declaring a national emergency with respect to the safety of telecommunications networks, the Trump administration cited increasing threats of cyber espionage and exploitation of vulnerabilities in U.S. infrastructure. Huawei has repeatedly denied that it would engage in espionage on behalf of the Chinese government despite concerns from the U.S. government and others that it could be compelled to do so under China’s National Intelligence Law.

In a statement, Huawei criticized the administration’s decision and said that rather than making the United States “more secure or stronger,” the choice would “only serve to limit the U.S. to inferior yet more expensive alternatives, leaving the U.S. lagging behind in 5G deployment.” In particular, the ban on Huawei equipment could harm smaller wireless providers who rely on the cheaper equipment the company provides. The executive order did not define numerous aspects relevant for implementation including the process for selecting banned companies and whether subsidies will be provided to assist rural carriers or others affected by the ban. Rules and regulations implementing the ban will be published by the commerce secretary within 150 days.

Although the executive order and entity listing collectively represent the U.S. government’s most assertive action against Huawei to date, it is not the first effort to exclude the company from parts of the U.S. market. In 2014, the U.S. government prevented the company from bidding on government contracts, and in 2018, U.S. government agencies and contractors were barred from using Huawei and ZTE products. The a dministration has long sought to convince allied and partner countries to ban Huawei from their networks, and last week’s announcement may reinvigorate calls for the adoption of similar bans.

The Commerce Department’s entity list decision further exacerbates tensions with China and puts Huawei in a difficult position given its reliance on U.S. chips. Approximately 25 percent of Huawei’s suppliers are based in the United States and the company spent $11 billion on purchasing components from U.S. companies in 2018, including purchases of semiconductors. Already, major companies including Google, Intel and Qualcomm have cut off supplies to Huawei. The company has invested heavily in research and development, however, including developing its own mobile phone chip, which may help to ease the transition away from U.S. suppliers. The Commerce Department on Monday issued a 90-day “reprieve” during which U.S. suppliers may continue to supply existing (but not new) Huawei network equipment.

The Commerce Department action toward Huawei harkens to a similar move undertaken in March 2016 when ZTE, another Chinese telecommunications company, was placed on the list in relation to sanctions violations. However, the U.S. government reached a settlement with ZTE in March 2017, but in April 2018 when ZTE continued to violate sanctions law an export ban was again put in place. President Trump then reversed course in May 2018, a move that the Senate rejected. Eventually a compromise was reached, but the risk of losing access to U.S. components nearly crippled ZTE’s business.

U.S., China impose new tariffs, dimming prospects for a trade deal

On May 10, the United States raised the tariff rate on $200 billion of Chinese goods from 10 percent to 25 percent. The Office of the U.S. Trade Representative has also released for public comment a proposal that would impose tariffs of up to 25 percent on another $300 billion of goods. China responded by raising the tariff rate to as high as 25 percent on over 5,000 U.S. products worth some $60 billion. China’s tariffs go into effect on June 1. Under the new regime, Beijing would maintain four different tariff rates on various U.S. goods: 25 percent, 20 percent, 10 percent, and 5 percent. China does not import enough from the U.S. to match Trump’s new tariffs, but many of Beijing’s duties target the exports of U.S. farmers in states critical to Trump’s reelection. On May 23, the Trump administration announced $16 billion in aid to assist farmers hit by tariffs.

In the meantime, trade negotiations have stalled. In recent weeks, Chinese negotiators had refused to make significant concessions on key topics ranging from cybersecurity practices to state subsidization of industry. Trump on Friday argued that China “took out a lot of the things that we negotiated that were done.” The Chinese response has been defiant. State-run newspaper Xinhua argued that the “the impact of the trade bullying measures of the United States will be overcome” and repeated a slogan that has become popular among certain Chinese netizens: “If you want to talk, the door is open; if you want to fight, we will fight to the end.” The Chinese social media group Taoran Notes, which comments on the trade war, argued that “it is better to suspend the consultation completely” than to continue talks without a sincere commitment to resolution.

The new tariffs are likely to prove damaging for both the U.S. and Chinese economies, and it remains to be seen whether Trump’s latest move will lead the Chinese to make more concessions at the negotiating table. Various analysts have argued, for example, that Beijing may still have other cards to play. Forbes has noted that in addition to adjusting its tariff policies, Beijing could let the renminbi’s value slip or harass U.S. businesses in China with slow approvals and stricter regulatory checks. Other analysts have argued that China can find other markets for its goods.

President Trump has also found himself under increased scrutiny, as farmers in particular continue to feel the effects of the tariff regime. As the Washington Post reported, some Republican lawmakers have taken the “unusual step of openly criticizing” the president. Sen. Chuck Grassley, the Iowan chairman of the Senate Finance Committee, has criticized Trump’s tariff policies and has warned that Trump could face political blowback if farmers continue to suffer economically. A slate of op-eds and investigative pieces from PBS, the Washington Post, and the Wall Street Journal, among other outlets, detail how Trump’s tariffs are placing new burdens on already beleaguered farmers around the country. CNBC, however, argues that despite these new burdens, there is “little indication Trump is paying a political price.”

In Other News

- Beijing-based Kunlun Tech Co Ltd has announced that it will sell LGBTQ dating app Grindr by June 2020. Kunlun finalized its acquisition of Grindr in January 2018. Grindr, a dating application geared towards gay, bisexual, transgender and queer people, boasts some 27 million users. U.S. officials ordered Kunlun to sell the app, arguing that Beijing could exploit the personal user data contained on the app to blackmail users who might have security clearances and ties to the U.S. national security establishment. Julian Gewirtz and Moira Weigel, writing for the Guardian, argue that such developments are proof that the “grand U.S.-China competition, usually spoken about in political or military terms, will enter in the most intimate lives of ordinary citizens.”

- A CNBC report reveals the vast strides in facial-recognition technology that various Chinese firms have made in recent months and years. The piece profiles Shanghai-based YITU Technology, which developed the Dragonfly Eye System, a “facial scanning platform that can identify a person from a database of at least 2 billion people in a matter of seconds.” China’s facial recognition database, the article noted, now covers nearly all of China’s 1.4 billion citizens. Despite the trade war, many of China’s facial-recognition tech firms are continuing to boom. Chinese artificial intelligence company Megvii Technology, for example, recently raised $750 million in its latest funding round.

- On May 17, Canadian Prime Minister Justin Trudeau announced that the U.S. and Canada had reached an agreement on the lifting of U.S. tariffs on Canadian steel and aluminum. The Mexican government had already reached a deal with the Trump administration before Trudeau’s announcement. Despite Trudeau’s jubilation, trade analysts have noted that there is more to the U.S.-Canadian deal than meets the eye. The joint statement, for example, would affect Sino-Canadian trade, as it requires the Washington and Ottawa to “implement effective measures” to prevent the “transshipment of aluminum and steel made outside of Canada or the United States to the other country.” Trump has long accused the Chinese government of using transshipping to skirt trade barriers.

- China formally arrested Michael Kovrig and Michael Spavor on May 16. The two Canadians, who have remained in custody in abusive conditions since December 2018, have been accused of harming national security. A Chinese Foreign Ministry spokesperson noted that the two men have only been accused of wrongdoing and not formally indicted. Beijing arrested the two men after Canada arrested Meng Wanzhou, the Huawei CFO now being sought for extradition to the U.S. Some Canadian analysts have argued that Ottawa has few viable options in the current diplomatic spat. Canada’s opposition parties, however, have argued that Trudeau’s response thus far has been feckless, with the Conservatives criticizing the fact that Ottawa has yet to appoint an ambassador to China. The post has remained vacant since the Prime Minister removed Amb. John McCallum in January of this year following his comments related to the Meng Wanzhou case.

Commentary

In the Financial Times, Jonathan Hillman compares the technology infrastructure including 5G networks built by Chinese companies with the telegraph cables constructed by imperial Great Britain. In testimony before the House Committee on Foreign Affairs, Elizabeth Economy describes why the United States must adopt a strategy of smart competition in its relationship with China. A new report from Kristine Lee and Alexander Sullivan at the Center for a New American Security explores the increasingly prominent role that Chinese diplomats play in the U.N. system, including work on technological standards in the International Telecommunications Union. The House Committee on Oversight and Reform held a hearing on Wednesday on the risks posed by facial recognition, including its use in authoritarian states.

In the Washington Post, Jessica Chen Weiss discusses the impact of a spike of nationalist rhetoric in China as the nation prepares for a protracted trade war with the United States, while in Foreign Policy, Lauren Teixiera analyzes why Chinese state media initially adopted a relatively subdued tone on the trade talks before negotiations collapsed. For Brookings’s Order from Chaos blog, Jamie Horsley offers an introduction to the Chinese laws relevant for enforcing a trade deal. In the Wall Street Journal, Holman W. Jenkins Jr. argues that to resolve the trade war, the Trump administration should present terms for granting Huawei access to the U.S. market.

For Lawfare, Ben Buchanan reviews the ways that hackers, including from China’s APT-3 group, are exploiting National Security Agency tools exposed during security breaches. Bobby Chesney discusses updates on Cyber Command’s operational activities. David Kris explains why the U.S. intelligence community must begin pivoting to focus more on long-term cyber-threats from nation states rather than on issues of counterterrorism.