SinoTech: ZTE Fights Export Ban and Xi Outlines Cyber Goals

Published by The Lawfare Institute

in Cooperation With

A Trump administration trade delegation will arrive in Beijing later this week, kicking off the first official negotiations since the White House proposed retaliatory tariffs against China’s tech trade policies in March. The team, led by Trade Representative Robert Lighthizer, Treasury Secretary Steven Mnuchin, National Economic Council Director Larry Kudlow, and trade adviser Peter Navarro, will meet with Chinese economic czar Liu He, whose February trip to Washington failed to head off the then-nascent dispute. Informal negotiations between the two sides in late March also proved unproductive, and progress is likely to remain slow, as Chinese and American strategic interests appear difficult to reconcile. China seeks technological competitiveness with the United States, but the U.S. worries that this parity will come at its own expense. Recent actions indicate that both sides are prepared for a protracted struggle; the Commerce Department slapped Chinese telecom equipment giant ZTE with sanctions that could last up to 7 years, while President Xi Jinping recommitted to China’s model of state-directed development to achieve technological self-sufficiency.

ZTE fights back against U.S. export ban, as Huawei comes under renewed suspicion

ZTE, China’s second-largest telecom, has been fighting for its survival since the U.S. government imposed an export ban against the company last month. On April 15, the Commerce Department’s Bureau of Industry and Security (BIS) issued a denial order prohibiting ZTE from purchasing U.S. exports for a period of seven years, after the bureau found that ZTE had breached a March 2017 settlement agreement. That agreement had imposed penalties on ZTE for intentionally violating sanctions against Iran and North Korea. Several of the penalties, including the seven-year export ban, were suspended subject to the company’s compliance during a seven-year probationary period. BIS concluded on that ZTE had violated the agreement by failing to penalize executives involved in the original sanctions violations, and reimposed the export ban. A statement released by ZTE the next day questioned the penalty but did not explicitly deny the violation.

In a separate press release issued several days later, ZTE promised to “protect its legitimate interest with all the legally allowed measures.” BIS has since allowed ZTE to submit additional evidence, though it’s unclear what that evidence might show, and the sanctions will remain in force during the process. Since ZTE cannot appeal the denial order within BIS, the next step could be a judicial challenge. The company has promised to “exhaust administrative or legal remedies available to it under applicable U.S. laws.”

The denial order is likely to create existential problems for ZTE, which pled in administrative hearings that an export ban would “effectively destroy the Company.” ZTE relies on American suppliers, like chipmaker Qualcomm and optical manufacturer Lumentum, for as much as 30 percent of its components and will have to rapidly alter its supply chains if the order remains in effect. ZTE will be in even more dire straits if the ban extends to intellectual property licenses or software—for instance, if it costs ZTE its license to produce and sell phones using Google’s Android operating system. But the ban will also have knock-on effects for American manufacturers who rely on sales to ZTE and could spur Chinese manufacturers to accelerate their own development of computer chips, other components, and even operating systems.

U.S. actions may also touch Chinese telecom-giant Huawei, which laid off American employees and reduced its Washington lobbying presence last month in an apparent recognition of its inability to overcome consistent opposition from U.S. lawmakers. Reports last week indicate that the Justice Department is investigating whether Huawei also violated U.S. sanctions against Iran. An export ban similar to ZTE’s would certainly hurt, but Huawei, the more successful of the two companies, would likely be better able to withstand challenges to its supply chains.

The ZTE denial order adds to a growing number of actions by the Chinese and American governments that threaten long-term harm to their respective tech industries. In contrast to the Trump administration’s proposed tech tariffs, which will go into effect until at least the end of the month, the Commerce Department’s export ban threatens to seriously harm ZTE’s development, or even put the company out of business, if Chinese officials choose to allow that. In a similar move, China’s Ministry of Commerce appears reticent to approve U.S. chipmaker Qualcomm’s acquisition of Dutch competitor NXP, an important move in the American firm’s long-term strategy. Trump’s rhetoric on the campaign trail focused on the trade deficit, but a more fundamental U.S.-China struggle concerns technological preeminence and market access. These underlying strategic concerns are receiving increased attention as the trade conflict wears on.

A strategy of trade conflict through domestic regulation is also more difficult for the Chinese government to attack. The Chinese trade policies that Trump and his administration have railed against are predominantly carried out by domestic agencies, and Chinese officials continuously stress the importance of acting in compliance with domestic regulation. It is difficult for those agencies to criticize similar actions by U.S. agencies without appearing hypocritical. The Chinese Ministry of Commerce’s statement on the ZTE export ban, for instance, acknowledged that “China always requires Chinese enterprises to obey the laws and policies of the host country.”

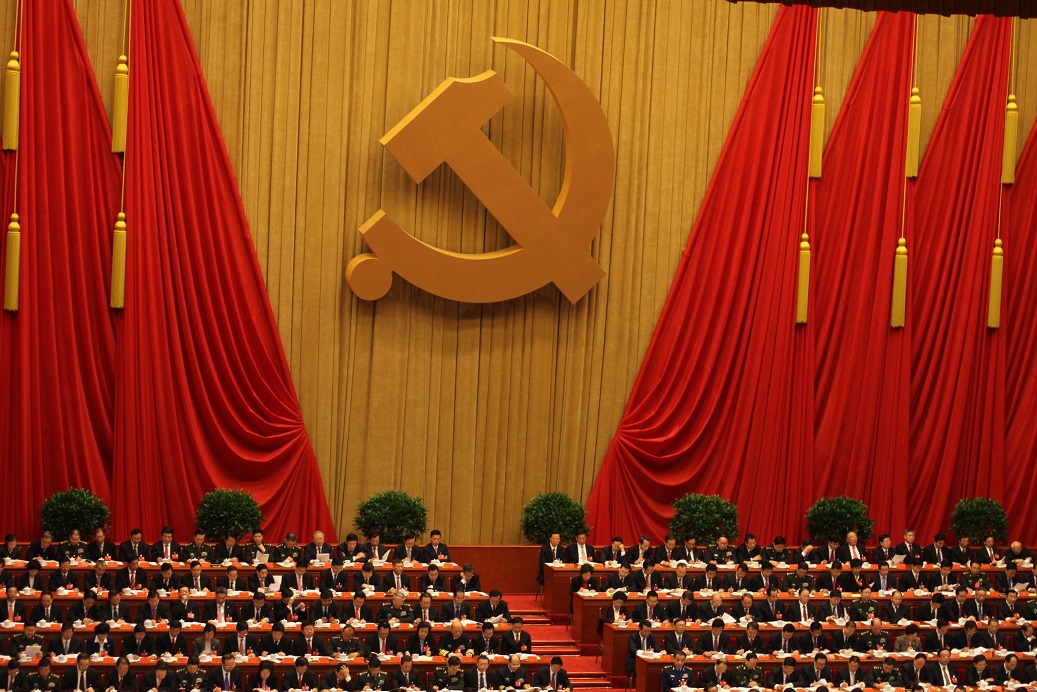

Xi outlines China’s cyber goals and semiconductor plans

As the U.S. launched new measures against Chinese tech companies, President Xi called upon his nation to grasp the “historic opportunity” to indigenously develop China’s strength in cyberspace and tech manufacturing. On April 21, at a national conference on cybersecurity and informatization, Xi outlined a blueprint for “independent and innovative development” in China’s cyberspace. He urged a strengthened role in cyberspace for government, led by the party, to spread positive information and uphold appropriate opinions. Xi also emphasized the importance of cybersecurity and pledged that China would improve protections for its information infrastructure, develop a professionalized cybersecurity industry, enhance response capabilities for emergencies, and impose duties on operators and regulators for proper maintenance and surveillance of cyberspace. To facilitate progress in those areas, Xi suggested that China combine strengths from the individual knowledge of its local experts, the industrial knowledge of its manufacturers, and the policy-making knowledge of its national government.

Perhaps most notably, Xi urged Chinese firms to continue developing their capabilities to manufacture semiconductors and other critical technologies and promised state support for tech firms targeted by recent U.S. trade actions. The rhetoric reflects widely held concerns among Chinese officials. Although the trade conflict has not yet affected China’s domestic industries, U.S. actions have highlighted China’s dependence on foreign manufacturers for many high-tech goods. Semiconductors are the most high-profile of these goods, and worries about supply chain vulnerabilities have prompted a frenetic push to establish an internationally competitive semiconductor industry.

The next day, in his congratulatory message to the opening ceremony of the first Digital China Summit, President Xi re-emphasized the importance of technological innovation for China’s continued development. On April 26, during an inspection of two leading chipmakers in Wuhan’s high-tech development zone, Xi stated that “independent core technology determines the survival of businesses,” and encouraged the manufacturers to continue pushing their development. Xi framed the current “unprecedented challenges” faced by Chinese chipmakers as “unprecedented opportunities” for them to seize autonomy and eventually take the global lead in chip technology.

In Other News

- Human Rights Watch released a report last week detailing discriminatory hiring practices at leading Chinese tech companies. Those firms, including internet giants Baidu, Alibaba, and Tencent, posted job listings soliciting only male applicants, and advertised to those applicants by promising that “beautiful girls” worked at their firms as “late night benefits.” Similar hiring practices have been documented in the past, but HRW’s report brings renewed media attention and public scrutiny. The report had an immediate effect; the firms involved quickly removed the relevant postings and provided contrite apologies to U.S. press outlets.

- Chinese ridesharing firm Didi Chuxing entered the Mexican market last week, posing a new challenge to American competitor Uber, which holds an 87 percent market share in Mexico. Uber surrendered the Chinese market in 2016, selling its UberChina division to Didi in exchange for a 20 percent stake and $1 billion in investment. The two companies have been battling for global dominance since, although Didi’s Mexican entry marks one of its first attempts to export its own app abroad instead of partnering with local competitors. Didi, like Uber, is planning a move into car-sharing arrangements, and may launch an initial public offering by the end of this year, ahead of Uber’s expected 2019 IPO.

- American cybersecurity firm FireEye has accused a Chinese hacking group of penetrating Japanese industry firms, possibly to gain insight into Japan’s positions on the North Korean missile crisis. FireEye attributed the attacks to a group that it has labeled APT 10 but is more widely known as MenuPass, which FireEye characterizes as operating “in support of Chinese national security goals, including acquiring valuable military and intelligence information.”

- A social media post by a low-level Communist Party official in Anhui Province indicated that he had been able to access deleted messages from communications and payment app WeChat. Tencent, WeChat’s parent company, was quick to issue a denial, but the post was widely circulated on Chinese social media until it was removed on Sunday.

Commentary and Analysis

Elsewhere on Lawfare, Kanzanira Thorington examines the Trump administration’s Section 232 tariffs on steel and aluminum, and Stephanie Carvin reviews “Army of None: Autonomous Weapons and the Future of War,” a new book from Center for a New American Security tech director Paul Scharre. On last week’s Cyberlaw Podcast, Stewart Baker and Jim Lewis discuss the Commerce Department’s actions against ZTE (relevant discussion begins at 13:15); that discussion is continued in this week’s episode (at 6:30).

At The Diplomat, Jesse Heatley analyzes the ambitious agenda for semiconductors outlined in President’s Xi’s speech at the Chinese conference on cyberspace. In the Bulletin of the Atomic Scientists, Lora Saalman discusses how China’s artificial intelligence capabilities may impact its nuclear strategy. At the Center for Strategic and International Studies, Samm Sacks outlines the developing framework of China’s data protection regime. A new report from the congressional U.S.-China Economic and Security Review Commission investigates "Supply Chain Vulnerabilities from China in U.S. Federal Information and Communications Technology."

In the Nikkei Asian Review, Cheng Ting-Fang examines China’s push to develop its national semiconductor industry. In the Wall Street Journal, Andrew Tangel and Theo Francis observe the disparate impacts that U.S. tariffs may have on American manufacturers. In The Atlantic, Dipayan Ghosh and Joshua Geltzer discuss the continued blurring of national-security and economic rationales for trade. Keith Bradsher outlines the techniques of Chinese tariff dodgers for the New York Times.