U.S. and China Strike Phase One Trade Agreement; Washington Steps up Efforts to Block Chinese Tech Amidst Mounting Opposition

Lawfare’s biweekly roundup of U.S.-China technology policy news.

Published by The Lawfare Institute

in Cooperation With

U.S. and China Announce Agreement on Phase One Trade Deal

On Dec. 13, 2019, President Trump announced that the U.S. and China had agreed to a “Phase One” trade deal. Under the agreement, the U.S. will roll back tariffs on Chinese goods in exchange for more U.S. goods purchases and structural reforms from the Chinese side. According to Trump, he will sign the deal on Jan. 15 with Chinese representatives at the White House. If the signing goes as planned, it will represent the first agreement between the U.S. and China to reduce import duties since the two countries began implementing bilateral tariffs in July 2018.

So far, most details of the agreement have not been made public. But as for U.S. commitments, Trump on Dec. 13 already canceled new 15 percent duties scheduled to hit $160 billion of Chinese exports on Dec. 15. Additionally, the Office of the U.S. Trade Representative (USTR) has confirmed that the U.S. will reduce tariffs on $120 billion of China’s exports from 15 percent to 7.5 percent. According to Chinese Vice Commerce Minister Wang Shouwen, the Trump administration will make these cuts in phases, though neither side has specified a timeline. Tariffs of 25 percent will remain, meanwhile, on $250 billion of Chinese goods.

As for China’s commitments, China has already cut tariffs on a slew of agricultural products and commodities. The USTR also reports that China will raise its imports of U.S. goods to $200 billion above 2017 levels—though China has yet to commit to import quantities for specific goods, like agricultural products. China has further pledged to heighten intellectual-property protections, end forced technology transfers and liberalize its financial services; however, the deal does not touch Chinese government subsidies to domestic firms. The deal also includes a process by which the U.S. may impose punitive tariffs if China does not adhere to its promises.

The Phase One deal has handed outsize benefits to U.S. and Chinese tech companies. Technology products (along with other consumer-retail goods) were disproportionately represented among the imports originally scheduled for new tariffs on Dec. 15. U.S. tech companies like Apple that produce in China will no longer see foreign-manufactured goods like phones and computers slapped with tariffs. And as analysts at Morgan Stanley have noted, following the deal, technology companies in China will likely experience the largest valuation increases among Chinese firms. Foreign financial firms may also be winners from the deal. Both sides have represented that, as part of the trade agreement, China will for the first time allow foreign companies to enter its financial sector without a joint venture. (China had already announced in July 2019 that it planned to abolish this joint-venture requirement.) This forthcoming change may also expand financing opportunities for firms raising funds in China.

Business groups in the U.S. have widely praised the deal as a positive step, and U.S. stocks rallied on news of the deal. Some commentators have argued that the Phase One agreement—which had remained in doubt for months—signifies a thaw in U.S.-China tensions and sanguine prospects for future agreements. Chinese negotiators are, reportedly, already attempting to work with the Trump administration in hammering out the next phase of the deal.

Still, reactions in the U.S. to the substance of Trump’s deal have been mixed. Although U.S. officials have touted the deal’s impact on the American economy, commentators have criticized it for resulting in few tangible concessions—particularly on structural reforms—that China had not previously been willing to make. And many remain skeptical that, even with this deal, the two sides will reach further trade agreements before November’s presidential election. Reports also suggest that Chinese leaders consider the deal a huge victory—and one that justifies a hardline approach to future U.S. trade talks.

State Department Steps Up Efforts to Block Chinese Tech Imports, but Faces Mounting Opposition

Reporting broke in December 2019 that the State Department has, in recent months, attempted to stop American companies from purchasing Chinese technology components. The State Department’s under secretary for economic growth, energy, and the environment, Keith Krach, has led the initiative, which asks firms to sign a set of principles titled the Global Digital Trust Standard (GDTS). The GDTS would, in effect, commit firms not to buy products from Huawei and possibly other Chinese companies. Krach has reportedly approached 13 business entities—including telecom carriers AT&T and Verizon, as well as chip manufacturers—about signing the GDTS. None appear to have signed.

The GDTS—by covering U.S. purchases, not sales—represents a more expansive attempt to influence U.S. supply chains than many past government actions against Huawei. But it also builds on recent steps in this direction by the Trump administration. On Nov. 26, the Commerce Department proposed a process for reviewing, and possibly prohibiting, information technology acquisitions from “foreign adversar[ies].” These measures are widely considered to target Chinese companies like Huawei (although they have yet to take effect). Last month, the Federal Communications Commission (FCC) also labeled Huawei and ZTE national security threats. This categorization bars purchases of their products through an FCC fund subsidizing rural telecom services.

The State Department’s requests, however, have met significant resistance from U.S. companies. Corporate leaders worry that signing the GDTS will commit them to anticompetitive behavior, exposing them to antitrust lawsuits. Concerned about higher costs and supply-chain disruption, businesses are also increasingly rebuffing Washington’s broader efforts to regulate tech imports, with many pushing back against the Commerce Department’s Nov. 26 purchase-review proposal. Unease about that rule change—and the review process’s complexity—led many trade associations on Dec. 6 to request a two-month extension to the rule’s comment period.

Chinese opposition to U.S. restrictions on Huawei has likewise grown more forceful, which may portend rising tensions on tech issues between the two countries. On Dec. 18, the Chinese state-owned paper China Daily published an editorial condemning U.S. efforts “to put Huawei out of business” as “dangerous” and “nothing but protectionism.” Huawei, meanwhile, has lately tried to market itself to American allies as more faithful than the U.S. to shared western values. And Huawei announced plans in December to sue the FCC for deeming it a national security threat without due process. This legal challenge may compound U.S. firms’ fears about antitrust lawsuits should they cease importing Huawei goods.

It is not yet clear how the pushback will affect the Trump administration’s import-regulation efforts. Trump has continually ramped up restrictions against Huawei since May 2019, when he placed Huawei on a blacklist—still just partially implemented—that precludes it from purchasing U.S. components. However, there are some signs that regulators are open to tweaking such policies in response to feedback. Throughout November and December, the Commerce Department issued export licenses to certain companies applying for exceptions from the ban against selling to Huawei.

In Other News

Reports emerged on Dec. 15 that the U.S. expelled two Chinese diplomats last September for suspected espionage after the two officials drove onto a military base in Virginia. At least one of the diplomats, U.S. officials suspect, was an undercover Chinese intelligence officer. The decision represents the first espionage-related expulsion of Chinese diplomats in more than 30 years. After reports of the event broke, China denied that the embassy officials engaged in any wrongdoing and urged the U.S. “to correct its mistake.” The expulsions come amidst growing concerns among intelligence agencies worldwide that China is conducting espionage on a “mass scale.” Shortly after reports of the expulsions emerged, separate reporting indicated that a Chinese student had stolen research materials from a lab in Boston as an act of suspected biotechnology espionage.

Beijing last month reprimanded tech giants Tencent and Xiaomi for violating users’ data privacy with certain applications—including Tencent’s instant-messaging app QQ. Specifically, the government alleged that these apps violated national laws against collecting and selling personal data, such as through the use of designs that make it hard for users to delete accounts. In response to the transgressions, China’s Ministry of Industry and Information Technology (MIIT) on Dec. 19 published the names of dozens of problematic apps; it also threatened “punishment” if their problems were not addressed by the end of 2019. The crackdown gives force to an MIIT campaign announced last November to rein in mobile-app privacy violations, particularly among apps with high user volumes. Still, this campaign contrasts with Beijing’s recent efforts to scale up the government’s own data collection, which includes a Dec. 2 law requiring anyone registering a mobile number to undergo facial recognition scans. Following the government’s announcement, Tencent issued a public pledge to amend its privacy statements.

On Dec. 8, the Financial Times obtained information that the Chinese government has ordered that all foreign-made hardware and software be removed from state institutions within three years. The substitutions will occur steadily through 2022—30 percent in 2020, 50 percent the next year and 20 percent the final year—and they complement similar moves by the U.S. to restrict Chinese tech imports. Analysts suspect executing the replacement will be difficult, because Chinese substitutes for some foreign products fall well below those foreign products’ levels of sophistication and developer support. China has wanted to remove foreign tech from key government operations since at least 2014, and doing so fits in with its objective of technological self-reliance under its “Made in China 2025” program. Still, the announced three-year time frame is faster than expected, and the shift may harm some U.S. tech companies, which generate an estimated $150 billion in annual revenue from total sales to China. Some analysts expect, however, that major tech firms have anticipated and prepared for a move such as this.

Commentary

Paul Krugman argues in the New York Times that the Phase One trade deal achieves few of Trump’s objectives, while Max Boot contends in the Washington Post the benefits it will bring the U.S. are speculative. Writing for Foreign Policy, Peter E. Harrell predicts that the next phase of U.S.-China trade disputes will center on export and investment controls rather than tariffs. Michael Ivanovitch argues on CNBC that a Phase One deal will do little to end the U.S.-China trade deficit and forestall future trade spats.

Henry Paulson writes in the Washington Post that the U.S. needs to catch up with China on developing 5G technologies. For Project Syndicate, Ngaire Woods questions whether Huawei really poses a greater security threat to the U.S. than companies like Facebook. Yukon Huang and Jeremy Smith discuss for the Carnegie Endowment for International Peace why the U.S. and China should resolve their technology disputes in multilateral forums.

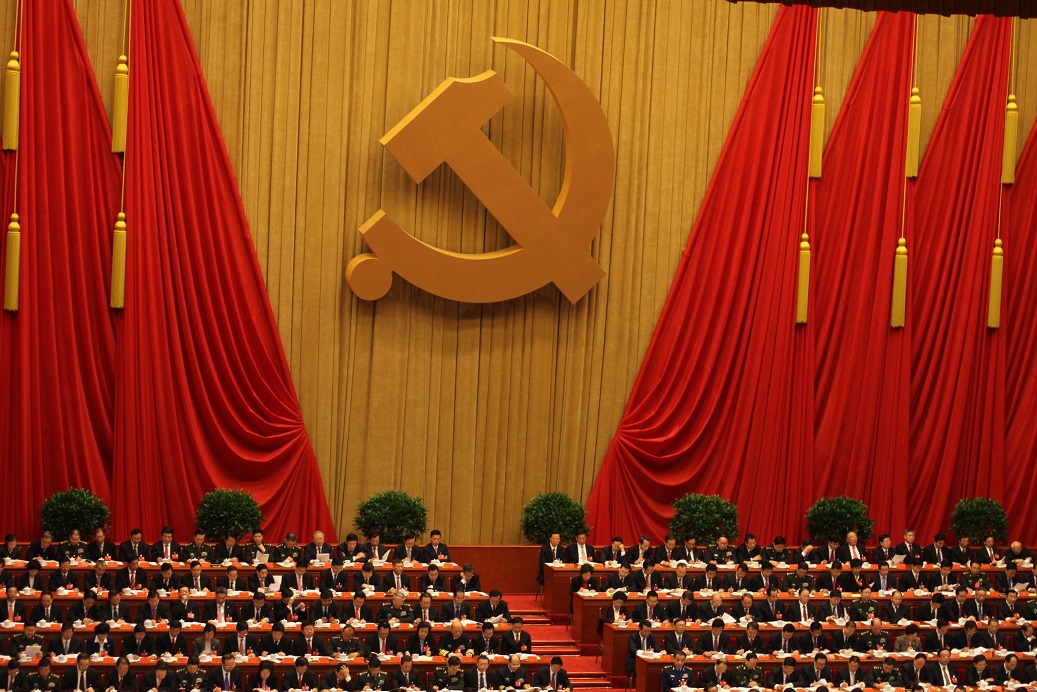

For the New York Times, Ian Johnson examines how the Chinese Communist Party is incorporating traditional Chinese values into its governing strategy, and Roger Cohen explores the origins of political unrest in Hong Kong. In the Diplomat, Remco Zwetsloot and Dahlia Peterson argue that China’s immigration practices hold it back from competing with the U.S. in tech.

For Lawfare, Christopher C. Krebs discusses how the Cybersecurity and Infrastructure Security Agency can tackle U.S. cybersecurity vulnerabilities. Richard Altieri and Benjamin Della Rocca explore potential U.S. executive and legislative responses to Xinjiang internment camps. Tom Wheeler explains how Trump administration policies have set the U.S. back in its competition with China on 5G technologies.