The U.S. Is Continuing Its Campaign Against Huawei

Huawei has not dominated recent headlines nearly as much as it did under the Trump White House. Yet that does not mean the U.S. campaign against Huawei has stopped.

Published by The Lawfare Institute

in Cooperation With

Huawei has not dominated recent headlines nearly as much as it did under the Trump White House. Yet that does not mean the U.S. campaign against Huawei has stopped. On the contrary: Huawei still sits on lists of foreign technology companies whose equipment and services pose a national security threat to the United States—and the Biden administration has continued the U.S. campaign against the Chinese technology firm.

U.S. pressure on Huawei has even expanded in important ways under Biden. The expansion of this campaign against Huawei technology has spanned the Federal Communications Commission (FCC), the State Department, and the Commerce Department, among others. Much of it builds on actions taken and plans initiated under the Trump administration, but there are many indications, including the Biden administration’s emphasis on diplomacy, that the current White House is taking a more comprehensive approach to the questions arising from foreign technology and the risks it can pose to national security. This change in particular may position the U.S. federal government for better supply chain security policy in the long run.

The most recent step came from the FCC on July 13 when the agency modified the rules for its supply chain reimbursement program, which financially compensates eligible communications providers that remove, replace or dispose of equipment in their networks that poses national security risks. While there are five Chinese firms whose equipment or services currently fall under this category of posing “an unacceptable risk to the national security of the United States or the security and safety of United States persons,” Huawei and ZTE technology are more pervasive in U.S. telecommunications networks than the other three. Many domestic providers have been looking to remove and replace Huawei and ZTE equipment, but that process is costly—for smaller firms, often prohibitively so. The July 13 change follows work done by Congress in 2019, when it passed the Secure and Trusted Communications Networks Act. That piece of legislation established mechanisms to stop national security-threatening technology from entering U.S. networks and established the Secure and Trusted Communications Network Reimbursement Program to “supply small communications providers (i.e., providers with 2 million or fewer customers) with funds to offset the cost of removing prohibited equipment or services from their networks and replacing it with more secure communications equipment or services.”

The FCC then set about calculating the funding needed for the effort. In September 2020, the FCC estimated it would cost $1.837 billion for eligible companies to replace Huawei and ZTE equipment in their networks; an FCC public filing that same day listed 50 telecommunications carriers eligible for reimbursements, ranging from small carriers like Bristol Bay Cellular Partnership (Alaska) and Mark Twain Rural Telephone Company (Missouri) to large firms like CenturyLink and Verizon. In December 2020, Congress allocated $1.895 billion for the FCC to carry out its reimbursement program. It also raised the eligibility cap from providers serving 2 million or fewer customers to those with 10 million or fewer customers. The FCC’s recent rule modification put these changes into place and significantly moved the needle forward on swapping out Huawei and ZTE equipment in U.S. telecommunications networks for equipment deemed more trustworthy.

The State Department is also continuing its efforts to limit Huawei’s global reach. Under the Trump administration, the diplomatic campaign against Huawei technology was plagued by a top-down White House emphasis on the U.S.-China trade war, Trump’s personal fixation on appearing “tough” against Beijing—not to mention a confused and contradictory set of messages that made key American allies and partners question whether U.S. concerns were really about security or instead about using Huawei as a political bargaining chip in economic negotiations. In short, the Trump-era anti-Huawei diplomatic campaign was largely unsuccessful; even as many allies and partners started to ban or sideline Huawei from their 5G networks in 2020, those decisions were often the result of independent political factors more than any semblance of suddenly improved White House messaging. The State Department under Biden has not been publicly vocal about Huawei, but Huawei’s technology and the reach of Chinese tech firms appear to remain key issues for the diplomatic apparatus. In June, the G-7 countries agreed on an infrastructure plan to contest Beijing’s Belt and Road Initiative, including a focus on technology. Shortly thereafter, the EU-U.S. Trade and Technology Council was launched at the EU-U.S. summit in Brussels; leaders placed a heavy emphasis on cooperating to promote innovation and convergent technology policy in contrast to Chinese technology influence. Meanwhile, the State Department has an opportunity to figure out, post-Trump administration, how to diplomatically position the U.S. with respect to Huawei and to Beijing’s growing technology influence globally.

The Commerce Department under the Trump administration placed many restrictions on U.S. companies doing business with Huawei, and those restrictions remain in place. Much of this revolved around the Entity List—a list of foreign entities with which American firms’ business is subject to special licensing requirements—maintained by Commerce’s Bureau of Industry and Security. Secretary of Commerce Gina Raimondo told reporters in April that “[t]he fact is, China’s actions are uncompetitive, coercive, underhanded, they have proven they will do whatever it takes, and so I plan to use all my tools in my toolbox as aggressively as possible to protect American workers and businesses from unfair Chinese practices.” Raimondo added that national security adviser Jake Sullivan was leading a review of Chinese companies and related issues, including with Huawei, and that “[a] lot of people have said, will Huawei stay on the Entity List, I have no reason to believe that they won’t, but we are in the middle of an overall review of China policy.” On July 9, the Bureau of Industry and Security added 23 entities in China to the Entity List but did not modify anything pertaining to Huawei. Most recently, the White House has lined up new bureau leadership. On July 13, Biden nominated former Pentagon official Alan Estevez to run the bureau, with confirmation pending. If confirmed, Estevez’s decisions on whether to keep, discard, or modify the bureau’s restrictions on Huawei will be a key factor in Huawei’s future growth—especially as the company’s financials indicate that U.S. Entity List restrictions have already dented its revenue.

And the White House has broadly continued the U.S. campaign against foreign technology deemed to pose national security risks. On June 9, for example, President Biden signed an Executive Order on Protecting Americans’ Sensitive Data from Foreign Adversaries, which elaborated on measures in Trump’s May 2019 Executive Order on Securing the Information and Communications Technology and Services Supply Chain. Biden’s new executive order directed the federal government to “evaluate these threats through rigorous, evidence-based analysis” and said the process “should address any unacceptable or undue risks consistent with overall national security, foreign policy, and economic objectives.” It also laid out many specific criteria to be assessed when thinking about foreign tech firms that pose national security risks (e.g., Huawei), including:

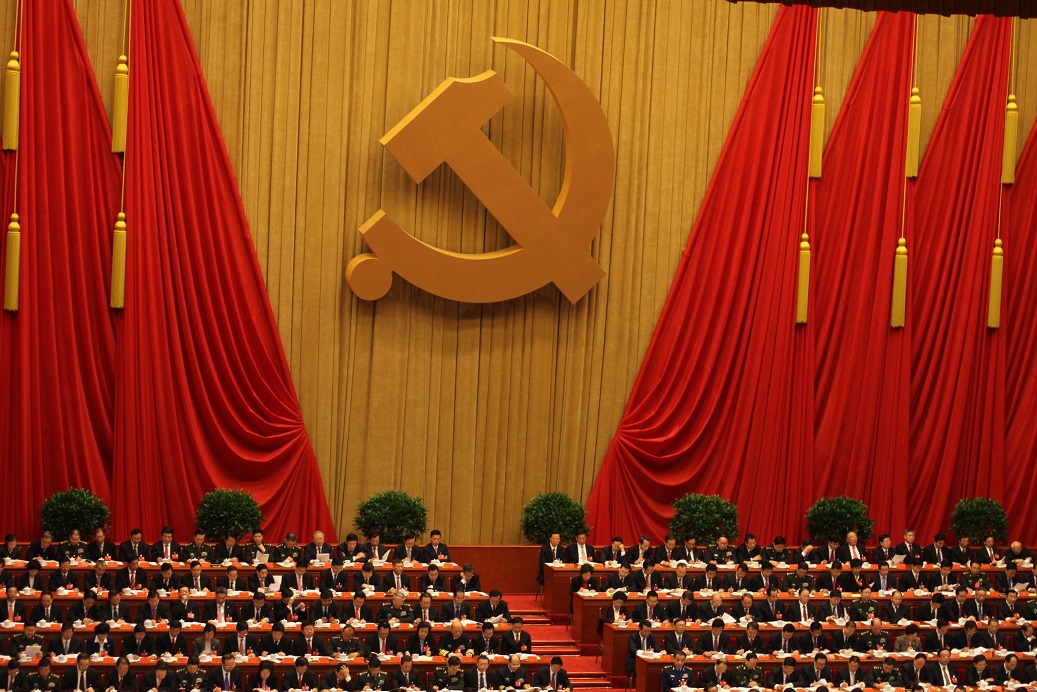

ownership, control, or management by persons that support a foreign adversary’s military, intelligence, or proliferation activities; use of the connected software application to conduct surveillance that enables espionage, including through a foreign adversary’s access to sensitive or confidential government or business information, or sensitive personal data; ownership, control, or management of connected software applications by persons subject to coercion or cooption by a foreign adversary; ownership, control, or management of connected software applications by persons involved in malicious cyber activities; a lack of thorough and reliable third-party auditing of connected software applications; the scope and sensitivity of the data collected; the number and sensitivity of the users of the connected software application; and the extent to which identified risks have been or can be addressed by independently verifiable measures.

Biden also signed an executive order on June 3, building off an executive order that Trump signed in November 2020, to limit U.S. company investment in Chinese firms that make surveillance technology for the Chinese government (specifically, to support the Chinese military-industrial complex or to facilitate “repression or serious human rights abuses”). Huawei was listed as a company supporting the surveillance technology sector in China. The Treasury Department’s Office of Foreign Assets Control added Huawei and all the other entities named in the order to its Non-SDN Chinese Military-Industrial Complex Companies List that is used to restrict such investments.

Is this any different from the U.S. campaign against Huawei under the Trump administration? The short answer is yes.

First, the FCC’s new program will greatly reduce Huawei’s presence in the United States. While the Trump administration already placed many restrictions on American firms’ ability to conduct business with Huawei—and while Biden has continued along that front—many U.S. telecommunications providers were already using Huawei equipment in their networks when the Trump administration’s “rip-and-replace” push began. Thanks to new congressional funding, the FCC will be able to make a large difference in reducing Huawei’s network and market presence in the United States by providing reimbursements for carriers that remove and replace Huawei (and ZTE) equipment. This is especially impactful for smaller telecommunications providers that would otherwise face significantly higher costs to find alternative suppliers for equipment that is already in use. The FCC’s focus to date has primarily been on Huawei and ZTE, based on the government’s security risk designations and which of those five designated firms have a considerable presence in U.S. telecom networks. But going forward, it is easy to imagine this program expanding to support the removal and replacement of other technologies in telecom networks deemed significant risks to U.S. national security. This will also mean that the processes for funding the program and determining which foreign companies’ technology merits replacing will become all the more important. Given there will be limited resources to reimburse companies that rip and replace designated equipment (even if the program’s budget is expanded), the FCC’s Public Safety and Homeland Security Bureau will have to continue prioritizing the most urgent risks to national security when considering what equipment to designate as posing unacceptable security risks.

The Biden administration is also placing a strong emphasis on diplomacy, in stark contrast to its predecessor. Even though many allies and partners shared the Trump administration’s nominal concerns about the Chinese government’s potential influence over Huawei (and thus the equipment it sold to 5G carriers globally), they questioned the administration’s motives in the so-called Huawei campaign. The execution of the diplomatic campaign itself—which in some cases entailed White House officials badgering foreign counterparts about security threats, without presenting evidence—ultimately hurt the U.S. in trying to convince others to get on board with its total-ban position. That the Biden administration is emphasizing the importance of diplomacy, including promoting bilateral and multilateral cooperation on Chinese technology issues, marks a notable departure from the Trump administration. Not every country is going to agree with what the U.S. is pushing with respect to Huawei. But the empowerment of diplomats will likely make a big difference in many cases, such as in U.S. efforts to encourage the Indian government to keep effectively sidelining Huawei.

Finally, the Biden administration, in continuing the U.S. campaign against Huawei, does not appear to be playing the kind of whack-a-mole game that characterized the Trump administration’s approach to Chinese technology firms. The administration is continuing the U.S. campaign against Huawei, as documented throughout this entire post; the Chinese firm is receiving more attention than most. But this campaign against the company fits into a broader pattern. At multiple diplomatic summits and through multiple new policies, the Biden White House has articulated its focus on developing a broader approach to Beijing’s growing influence through and on technology, where Huawei is one (albeit large) piece of the puzzle. The administration has promoted interagency coordination on China in areas where the Trump administration frequently failed to do the same; Biden, Commerce Secretary Raimondo, Secretary of State Antony Blinken and other officials have repeatedly discussed the importance of a broad approach to China policy issues. To be clear, the Biden administration is still heavily focused on China, and that may come with its own complications. But many diplomatic engagements, the hiring of many China and technology experts to White House staff, and the new executive order setting out a criteria-based process for reviewing the security risks of foreign technology all contrast strongly with the Trump administration’s often-unpredictable focus on single firms at a time (e.g., TikTok) without a broader strategy. This may be the most significant change of all—the gradual building out of longer-term policies on the security risks of foreign technology that will only become more urgent over the next decade.